What do you want to do?

What is Pension Plan? Meaning, Types & How It Works?

Pension meaning refers to a long-term financial plan designed to provide a steady income after retirement. In India, a pension plan allows you to make regular contributions during your working years, which gradually build into a retirement corpus. This corpus is then converted into an annuity or a monthly income, ensuring financial security in old age. Such plans are essential for anyone seeking predictable post-retirement income and tax benefits under Indian regulations.

What is Pension?

So, what does pension meaning imply? After retirement, an employee may have a reliable source of income thanks to their pension. The employer and the worker contribute to a pension fund throughout a worker's working years. Defined benefit plans provide a certain sum for retirees. When people retire from their occupations, they should be able to keep living well because of various pension schemes and learning well about what is pension.

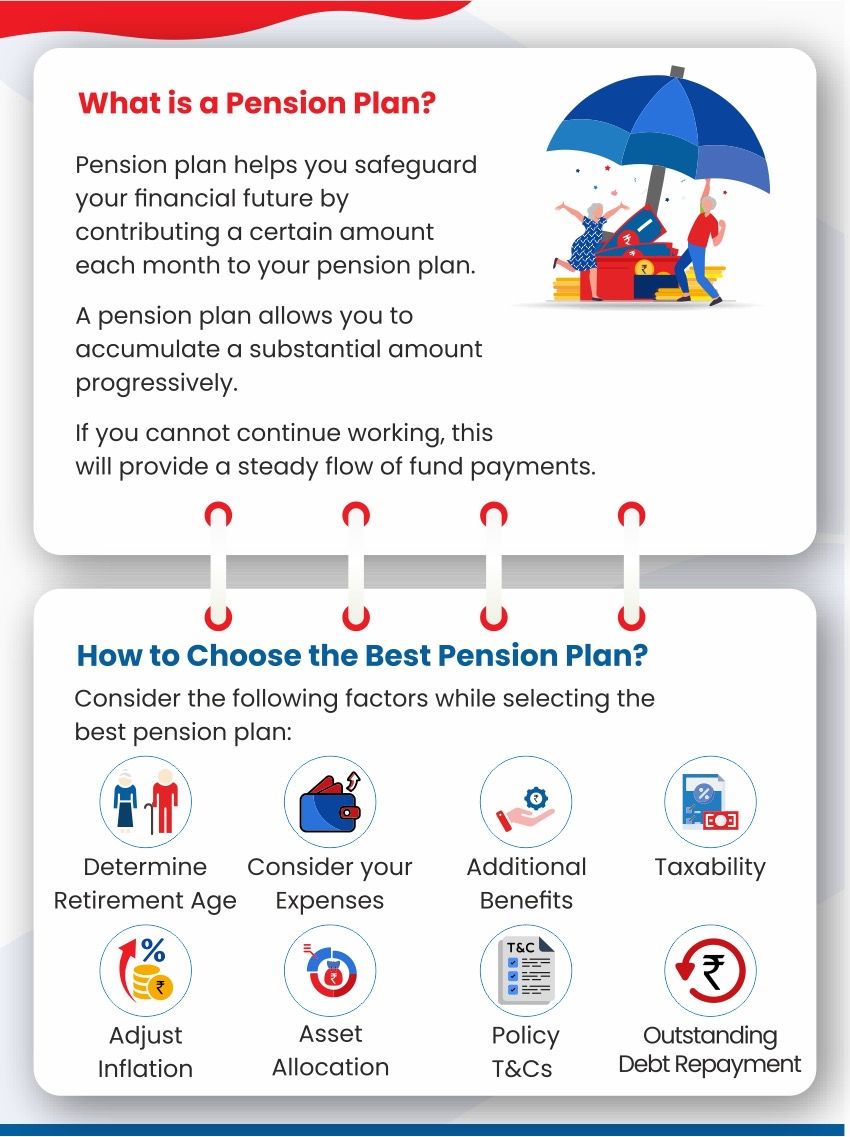

What is a Pension Plan?

So, what is a pension plan? You can safeguard your financial future by contributing to pension or retirement plans. Contributing a certain amount each month to your pension plan allows you to accumulate a substantial amount progressively. If you cannot continue working, this will provide a steady flow of fund payments.

The Public Provident Fund is one of India's best retirement savings schemes. The earlier you start saving for retirement, the more secure your financial situation will be in your golden years. A well-planned retirement account may allow you to beat inflation and secure your post-retirement life, thanks to the power of compounding.

How Does a Pension Plan Work?

The generation of a pension plan has two phases:

The Accumulation Phase: The Contributor or employer contributes a part of their earnings to the pension fund. This amount is invested in various financial instruments, including mutual funds, bonds, and stocks. Long-term investments lead to higher returns.

Retirement or Vesting Phase: Accumulated corpus is converted into a fixed stream of income. It is up to the contributor to decide whether they want to receive the payout in the form of a lump sum or regular monthly payments.

At the time of retirement, the employee has the freedom to opt for a certain percentage of the retirement corpus as a lump sum and the rest as annuity, meaning they will receive a steady monthly, quarterly or annual income for a predefined period.

Types of Pension Plans

Annuity Plan

Social Security Schemes

An annuity plan is a type of financial product where an annuitant makes a lump sum investment in exchange for a steady, fixed income during retirement. Depending on how the premium is paid, it could be a regular or a single premium pension plan. In such plan, the payout frequency can be predetermined on a monthly, quarterly, semi-annual, or annual basis.

Why Choose an Annuity Plan?

It provides a steady cash flow when the annuitant lacks a regular income, ensuring financial stability.

In May 2015, the Honourable Prime Minister of India launched three social security schemes to establish a universal social security system for all Indians, with a particular focus on the poor and underprivileged. These are:

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Available to individuals within the age range of 18 to 70, PMSBY enables pensioners to receive maximum benefits with minimal investment during retirement. With a minimum annual premium of ₹20, and ₹436, the scheme holder can receive an accidental benefit and a life cover of ₹2 Lakh, respectively.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Individuals within the 18 -50 age range with a bank account are eligible for this scheme. The LIC offers this scheme, and similar to the PMSBY, the scheme holder can avail of life cover and accidental cover of ₹2 Lakh.

Atal Pension Yojana (APY)

APY subscribers receive a guaranteed ₹1,000 to ₹5000 at the age of 60. Individuals between the ages of 18 and 40 who hold a savings account with a savings bank or a post office savings account are eligible for this scheme. After the death of the subscriber, the pension amount is paid to their spouse. When the spouse passes away, the pension amount goes to the nominees.

If the subscriber dies prematurely, their spouse is offered the option to continue contributions to the scheme for the vesting period, which lasts until the original subscriber would have turned 60.

Why Choose Social Security Schemes?

To provide financial protection against life’s uncertainties, vulnerable groups can opt for these schemes.

Deferred Annuity

A deferred annuity is a type of life insurance plan that provides a fixed income for a predefined period chosen by the annuitant. These plans enable annuitants to save during the earning years, so that they can utilise the saved amount post-retirement. If you are a long-term investor, the magic of compounding will help you build a larger retirement corpus.

Why Choose a Deferred Annuity?

These low-risk plans offer the opportunity to grow your funds and provide flexibility in choosing the payout period. Furthermore, these plans offer tax deduction benefits under Section 80C of the Income Tax Act#.

Immediate Annuity

An immediate annuity allows annuitants to start a steady income instantly after purchasing a plan. Unlike deferred annuity plans, with an immediate annuity, the annuitant must pay a lump sum at the outset. From the following month, or from a specified time in the future chosen by the annuitant, the payouts start.

Why Choose an Immediate Annuity?

If you are nearing retirement, an immediate annuity will provide a reliable source of income after retirement.

To ensure financial stability not only for oneself but also for one's dependents, an annuity is a wise choice. It also helps in creating a legacy.

Pension Plan with Life Cover

Life Annuity

Guaranteed Period Annuity

Unit Linked Insurance Plans (ULIPs) are among the most popular pension plans that offer life insurance coverage. While a portion of the ULIP premium is used to secure a life insurance cover, the remaining part is invested in various market-linked funds. This enables pensioners to safeguard their family's financial well-being and accumulate wealth over time.

Why Choose a Pension Plan with Life Cover?

These plans offer dual benefits, making them perfect for long-term financial goals. You only have to pay a unified premium to access both investment and life insurance cover.

Insurance companies sell life annuities as a financial product that provides lifetime stable payouts to the annuitant. During the working years, the annuitant can invest in this product or purchase it with a lump sum amount at the time of retirement. However, the life annuity payouts stop after the death of the annuitant. To continue the life annuity payouts, therefore, it is recommended to opt for a rider*

Why Choose Life Annuity?

If you are looking for a supplemental or guaranteed income post-retirement, a life annuity is for you. You have the flexibility to choose a payout frequency that suits your financial needs.

Irrespective of changes in interest rates or market volatility, guaranteed period annuity offers fixed, consistent, and predetermined payouts. Even if the annuitant passes away within the fixed period, the payouts continue.

Furthermore, these are tax-efficient. Therefore, understanding the income tax on pension helps retirees plan withdrawals better and manage their post-retirement tax liability effectively. As a consequence, when they retire, they can manage tax liability effectively.

Why Choose a Guaranteed Period Annuity?

It ensures a fixed income for a specified period, such as 10 or 15 years, regardless of whether the annuitant survives until the end of the term or not. This feature makes it ideal for individuals who want their dependents to have financial independence even in their absence.

Ways to Grow Your Retirement Savings with a Pension Plan

After working hard throughout life, you deserve a peaceful retirement during your golden years. Whether you want to spend more time with your loved ones, contribute to your child's higher education, or travel around the world with your spouse, you need a solid retirement corpus.

Here are some ways to grow your retirement savings with a pension plan:

National Pension System (NPS)

Public Provident Fund (PPF)

Unit Linked Insurance Plan (ULIP)

Employee’s Provident Fund (EPF)

Pension Fund

NPS is a government-backed retirement savings scheme that allows individuals to start investing regularly during their working years. Over time, the fund grows and builds a substantial retirement corpus. During retirement, you can withdraw a part of this corpus as a lump sum and invest the remaining amount to purchase an annuity plan.

PPF is one of the safest government-backed long-term savings schemes, offering guaranteed returns with a steady interest rate of 7.1% per annum and tax benefits. Under Section 80C of the Income Tax Act, 1961#, taxpayers can claim tax deductions up to ₹1.5 Lakh per annum. Since PPF has a 15-year lock-in period, it develops a disciplined savings habit.

ULIP is a market-linked insurance product that offers dual benefits, combining life insurance and investment. While one part of the ULIP premium provides life insurance coverage, the other part is invested in various market-linked funds. Upon maturity, the accumulated funds can be partially withdrawn, with the remaining amount used for an annuity.

EPF is a mandatory retirement savings scheme for salaried employees where both the employee and the employer contribute 12% of the employee’s basic salary. Consistent contributions to this fund help build a retirement corpus. The amount invested in this fund can only be withdrawn at the time of retirement. A partial emergency withdrawal is allowed after 5 years.

Pension funds are professionally managed long-term investment funds that help grow wealth over time, allowing you to spend your retirement with peace and stability. After accumulating these funds, invest in a mix of assets. As a consequence, it leads to stable returns and long-term income security.

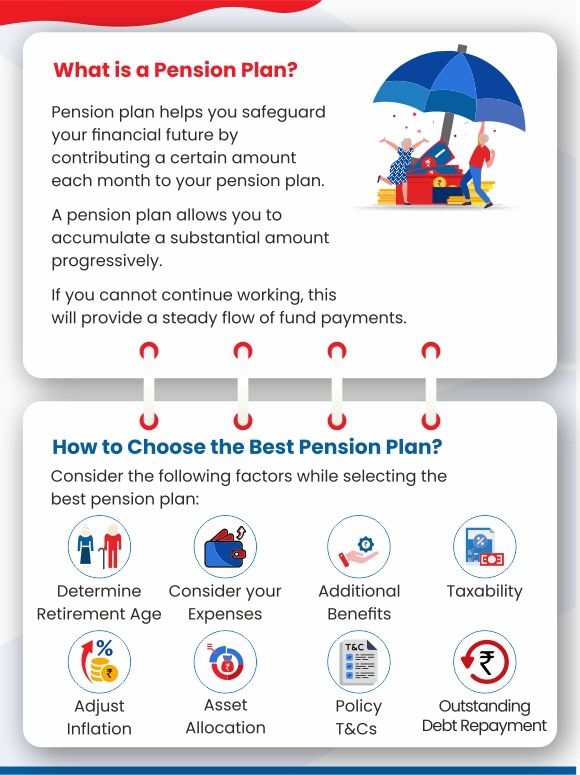

How to Choose the Best Pension Plan?

To choose the best pension plan, you need to factor in the following:

Maximum Retirement Age

Consider Your Expenses

Inflation

Asset Allocation

Added Benefits

Taxability

Policy Features

Policy Fees

Outstanding Debt Repayment

Every retirement plan comes with its own vesting age, which is the point at which payouts begin. So, determining your maximum retirement age is the first step. Whether you want to retire early at 55 or later at 60, ensure that your retirement plan aligns with your goals.

The best way to plan for your pension fund is to determine your current monthly expenses. This should include your daily necessary expenses, medical expenses, utility bills, and other essential costs.

To eliminate the risk of inflation eroding the value of your pension fund over time, it is crucial to consider the impact of inflation when determining the pension fund corpus.

If you invest in a single asset, market fluctuations can reduce your returns. However, allocating your funds in multiple assets, such as debt, equity, or hybrid funds, could help neutralise the effect of market volatility.

Some pension plans come with certain extra features such as riders*, life covers or guaranteed returns. Based on your personal requirements and financial goals, you can choose the most relevant option.

Having clarity on the Indian tax law regarding pension plans is essential. Under Section 80C of the Income Tax Act, 1961#, annual premium paid towards a pension plan is eligible for tax deductions up to ₹1.5 Lakh. Furthermore, under Section 80CCD of the Income Tax Act, 1961#, you can additionally claim ₹50,000.

Review the policy features in detail before investing. Each pension fund differs based on its guaranteed or fixed returns, payout frequencies, tenure, taxability and interest rates. Based on your own financial goals, you can make your choice.

Pension plans often incur specific fees for fund management and administrative expenses. Even for short-term investment options, policy fees are applicable, and these fees vary from one policy provider to another. Therefore, comparing policy fees of different policy providers is essential.

If you have taken out a home or personal loan, then considering the outstanding debt amount is crucial before allocating a substantial part of your earnings towards a pension fund. When you clear out your debts, it will make your retirement more peaceful with higher disposable income.

What Are the Risks of a Pension Plan?

Now that you know pension meaning, its types and how to choose the best plan, it is time to be informed regarding its potential risks, such as:

Market Risk

Many pension plans invest in equity or debt markets. A market downturn just before retirement can reduce the maturity amount and affect your expected pension income.

Annuity Rate Risk

Your retirement corpus is converted into a monthly income (annuity). If interest rates are low when you buy the annuity, your pension may be smaller despite years of saving.

Inflation Risk

In India, the cost of living, particularly healthcare, continues to rise steadily. A fixed pension amount may lose its purchasing power over time. For example, ₹40,000 per month today may cover far less 15 years later.

Longevity Risk

Living much longer than average may exhaust your savings, especially if your plan doesn’t guarantee lifetime income.

Late-Start Risk

Starting contributions late leaves less time for compounding and may force higher payments or a smaller pension.

Understanding the pension meaning and these risks will help you choose plans with inflation protection, flexible annuity options, and timely contributions.

Who is Eligible for a Pension?

Depending on the type of pension plan you are choosing, the eligibility requirements differ. Here is a breakdown of different types of pension plans and their eligibility criteria based on Indian Pension Schemes:

NPS Eligibility

Indian citizens and non-resident Indians (NRIs) or Overseas Citizens of India (OCIs) are eligible for NPS (National Pension Scheme) if they fulfil the following criteria:

The schemeholder has to be within the age range of 18 to 70 years.

Compliant with KYC norms as mentioned in the Subscriber Registration Form (SRF).

Persons of Indian Origin and Hindu undivided families are not eligible for NPS.

It is an individual pension account, so a third person cannot open an NPS on your behalf.

EPF/EPS Eligibility

To be eligible for the Employee Pension Scheme (EPS), an individual must be a member of the Employees' Provident Fund Organisation (EPFO). The following are its eligibility criteria:

EPF holders have to be within the age range of 18 to 54.

Their basic salary needs to be at least ₹15,000.

The employee must have served in an organised sector for at least 10 years.

Insurer Pension/ Annuity Plans Eligibility

The eligibility criteria for annuity plans or insurer plans depend on the type of plan. Here is a list of common considerable factors:

Individuals aged 20 to 60 years are eligible for this program.

The policy term has to be between 5 years and a maximum of 35 years.

Indian citizens as well as NRIs can purchase annuity plans.

Tips on Planning for Retirement With a Pension Plan

It is important to plan ahead to have sufficient funds in your retirement years, regardless of whether you rely on a pension. Here are some guidelines to follow so that you may maximise your pension benefits when you retire:

Understand Your Retirement Plan

From the prerequisites to the contribution amounts and vesting periods and everything in between, make sure you have a firm handle on your pension plan. With this information in hand, you can make a more informed decision regarding your retirement plans.Dealing with Inflation

You should factor in inflation as you save for retirement so your pension doesn't become worthless. They are assets to consider if you want to extend the life of your retirement funds and purchase additional stocks or real estate, which may grow in value more quickly than inflation.Regularly Review and Adjust Your Plan

At regular intervals, you should review your retirement plan and make any required adjustments to account for changes in your financial situation, lifestyle goals, or economic conditions. Be on the lookout for any changes to your pension plan or laws that affect your retirement savings at all times.

FAQs:

1. What do you mean by pension plan?

Many employers and groups provide pension plans to ensure that retirees have a certain amount of money after they stop working.

2. Do I need a pension plan if I have a PF?

While a Provident Fund (PF) is an option for retirement savings, you could be better off financially in the long run with a separate pension plan that offers even more money and benefits.

3. What is a pension in salary?

A pension in pay allows workers to save a portion of their wage each pay period to have access to benefits when they retire.

4. How is a pension plan different from a term plan?

Pension plans are designed to provide income in retirement, whereas term plans pay out a one-time lump sum payment to beneficiaries in the event of the policyholder's death while the policy is valid.

5. Why is pension important?

Pensions are vital because they relieve a great deal of financial stress in retirement by providing a steady income stream to cover basic expenses and keep people's standard of living at a certain level after they stop working.

6. What are the three types of pension?

The three types of pensions are defined contribution pension, defined benefit pension, and state pension.

7. How is a pension paid?

There are three options for pension payment. You can withdraw the entire retirement corpus in a lump sum irrespective of the amount, buy an annuity or take a cash lump sum, or withdraw a part of the corpus in lump sum (no restriction on the amount) and reinvest the remaining.

8. Which pension scheme is best?

The best pension scheme depends on the risk appetite, affordability, and financial goals.

9. Who is eligible for Pension Plans?

The eligibility criteria depend on the pension plans you choose. It is recommended you study the plan requirements before investing in one.

10. When is the right time to invest in a pension plan?

Any time is the right time to invest in a pension plan. However, starting to invest early has the advantage of creating a huge corpus owing to the power of compounding.

Conclusion

Retirement planning through investment in pension plans is crucial for a peaceful and stress-free retirement life. Now that you are aware of pension meaning, what pension plans are and the various types of plans available, you can invest in a plan that suits your financial goals as well as financial requirements and fits into your budget. Opting for pension plans with life cover and investment options ensures that your family does not face a monetary crisis in case of your untimely death while creating a substantial corpus to meet financial goals.

Related Article:

- How to Choose a Pension Plan for Retirement Planning

- Things to know about pension plans

- Key Features of Pension Plans You Must Know

- Tax Benefits of Various Pension Plans

Not sure which insurance to buy?

Talk to an

Advisor right away

We help you to choose best insurance plan based on your needs

Here's all you should know about Retirement Plans.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- Best Investment Plans

- What is Term Insurance

- Short term Investment options

- Saving plans

- ULIP Plan

- Health Insurance Plans

- Child Insurance Plans

- Group Insurance Plans

- Long Term Savings Plan

- Fixed Maturity Plan

- Monthly Income Advantage Plan

- BMI Calculator

- Compound Interest Calculator

- Term insurance Calculator

- Tax Savings Investment Options

- 2 crore term insurance

- 50 lakhs term insurance

- annuity plans

- Investment Calculator

- get pension of 30000 per month

- ULIP Returns in 5 Years

- investment plan for 5 years

- investment plan for 10 years

- 50 Lakh Investment Plan

- guaranteed returns plans

- sanchay plans

- Pension plans

- Retirement Calculator

- Pension Calculator

- Money Back Policy

- 1 Crore Term Insurance

- Types of Retirement plan

- term insurance plans

- life insurance

- life insurance policy

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. The name of the company, name of the brand and name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your insurance agent or the intermediary or policy document of the insurer.

@. Amount of guaranteed income will depend upon premiums paid subject to applicable terms and conditions.

@@. As per Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

#Tax benefits are subject to conditions under section 80C, 80D, 10(10D) as per Income Tax Act, 1961, and are subject to changes in tax laws. Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

*Riders / Add-Ons can be availed upon payment of additional premium.

In this policy, the investment risks in the investment portfolio is borne by the policyholder. The Linked Insurance products do not offer any liquidity during the first five years of the contract. The policyholders will not be able to surrender or withdraw the monies invested in Unit Linked Insurance Products completely or partially till the end of fifth year.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. HDFC Life Insurance Company Limited is only the name of the Insurance Company, The name of the company, name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns.

ARN- ED/09/25/26445

RETIREMENT PLANS BUYING GUIDE

RETIREMENT PLANS BUYING GUIDE