What do you want to do?

- Death

- Critical Illness

- Health

- Group

- NRI

- Rural

- Special Circumstances

- Pradhan Mantri Jeevan Jyoti Bima Yojana

Claim Online

3 quick steps to initiate a claim online

![before]()

Verify policy details

![after]()

![before]()

Submit life assured details

![after]()

![before]()

Submit nominees details

Claim at Branch

![before]()

Download & fill up

claim form![after]()

![before]()

Collect all the required

supporting claim documents![after]()

![before]()

Submit claim form and

supporting documents

Search results for "Tamilnadu" State

Address

Map

Documents Required for Death Claim:

For Natural Death

MANDATORY DOCUMENTS

- Death Claim Form

- Death certificate issued by local authority

- Claimant's passport size photograph

- Personalized Cancelled Cheque or Bank Passbook (with Printed A/c no, IFSC & Name account holder)

- Claimant's Valid Identity Proof

- Claimant's Valid Address Proof

- Claimant's PAN CARD/Form 60 (if PAN Card not available)

- Employer’s certificate (Form) for Life Assured, if employed (not required for pension/ annuity plans)

ADDITIONAL DOCUMENTS

- Original policy document (Not necessary in case of dematerialised policy document)

- Medical cause of death certificate

- Medical records for all the treatments taken in the past. (Admission notes, History / Progress sheet, Discharge /Death summary, Test reports, etc.)

Un-natural Death (Accidental death / Murder / Suicide)

MANDATORY DOCUMENTS

- Death Claim Form

- Death certificate issued by local authority

- Claimant's passport size photograph

- Personalized Cancelled Cheque or Bank Passbook (with Printed A/c no, IFSC & Name account holder)

- Claimant's Valid Identity Proof

- Claimant's Valid Address Proof

- Claimant's PAN CARD/Form 60 (if PAN Card not available)

- First Information Report (FIR)

ADDITIONAL DOCUMENTS

- Original policy document (Not necessary in case of dematerialised policy document)

- Panchnama /Inquest report

- Post-mortem report (PMR)

- LA ‘s Driving license

- Police Final Report

- Viscera report (if applicable)

- Newspaper cutting (s), if any,

- Others as applicable

- Employer’s certificate (Form) for Life Assured, if employed (not required for pension/ annuity plans)

Disaster / Natural Calamities

- Death certificate issued by Govt. / Relevant Authority

- Death claim form (includes NEFT)

- Original Policy Document (In Case of DEMAT, Original Policy Documents are not Required)

- Claimant's Valid Address Proof

- Claimant's Valid Identity Proof

- Claimant's PAN CARD/Form 60 (if PAN Card not available)

- Claimant’s photograph

- Personalized Cancelled Cheque or Bank Passbook

Notes:

- Self-Attestation is required on any photocopies of the KYC or any other document copies submitted by the Claimant.

- HDFC Life may call for documents apart from the above (case specific).

INT/CL/12/22/31049

Quick Claims Processing for Special Circumstances

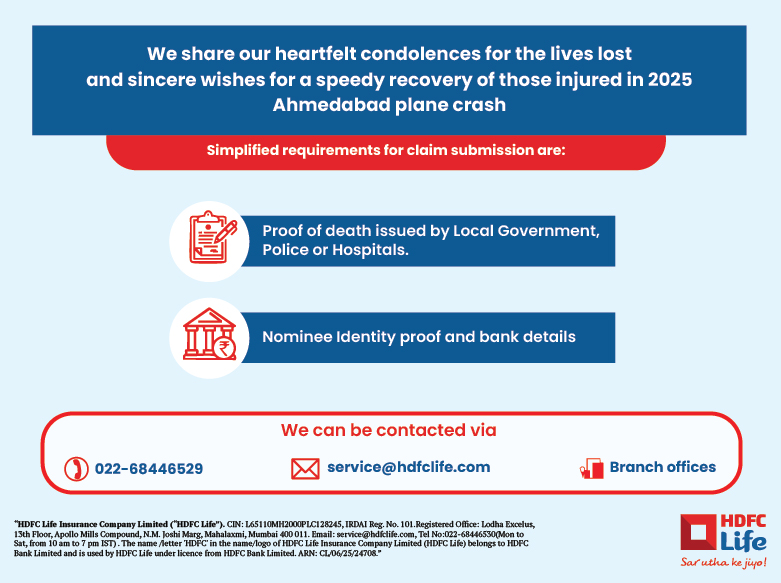

2025 Ahmedabad plane crash

We share our heartfelt condolences for the lives lost and sincere wishes for a speedy recovery of those injured.

We have relaxed the claim intimation guidelines for the 2025 Ahmedabad plane crash and are committed to processing them on priority to help them tide over the tough times they are facing.

Please find the list of documents required for claim processing:

Proof of Death by local government, Police or hospitals

KYC & Bank details of the nominee

For any further assistance,

Please write to us at: service@hdfclife.com

Or call us at 022-68446529, available from Mon-Sat from 10 AM to 7 PM (Local charges apply). Do not prefix any country code e.g. +91 or 00.

Our branch offices will provide all the required support to help you during the claim settlement process. Details of the HDFC Life branches and representatives are given below:

Branch Name |

Branch Address |

Nodal Officer* |

Contact Number |

Navrangpura |

115-117 Akshar Arcade opp Memnagar Fire Station , Vijay Cross Road,Ahmedabad – 380 009. |

Hardik Shah |

95588 21980 |

*The nodal officer would be available from 10:00 AM to 6:00 PM (Working Days).

2025 Pahalgam Terror Attack Victims

We share our heartfelt condolences for the lives lost and sincere wishes for a speedy recovery of those injured.

We have relaxed the claim intimation guidelines for the Pahalgam Terror Attack Victims and are committed to processing them on priority to help them tide over the tough times they are facing.

Please find the list of documents required for claim processing:

- Proof of Death by local government, Police or hospitals

- KYC & Bank details of the nominee

For any further assistance,

- Please write to us at: service@hdfclife.com

- Or call us at 022-68446529, available from Mon-Sat from 10 AM to 7 PM (Local charges apply). Do not prefix any country code e.g. +91 or 00.

Our branch offices will provide all the required support to help you during the claim settlement process. Details of the HDFC Life branches and representatives are given below:

Branch Name |

Branch Address |

Nodal Officer* |

Contact Number |

Srinagar |

HDFC LIFE, SARAH CITY CENTER, 2ND FLOOR, IG ROAD SRINAGAR 190001 |

Shomin Kapoor |

8558910871 |

Jammu |

HDFC LIFE, 2nd Floor, MS Gupta Tower, CB13, Rail Head Complex, Jammu and Kashmir - 180012 |

Arjun Singh |

8591784183 |

*The nodal officer would be available from 10:00 AM to 6:00 PM (Working Days).

2024 Andhra Pradesh-Telangana Floods

We share our heartfelt condolences for the lives lost and sincere wishes for a speedy recovery of those injured.

We have relaxed the claim intimation guidelines for the 2024 Andhra Pradesh-Telangana flood victims and are committed to processing them on priority to help them tide over the tough times they are facing.

Please find the list of documents required for claim processing:

- Written Death Intimation by the Claimant

- Attested death certificate issued by Local Government, Police or Hospital

- Identity & residence proof of Claimant

- Copy of bank pass book / Cancelled cheque leaf of the nominee for the NEFT purpose

For any further assistance,

- Please write to us at: service@hdfclife.com

- Or call us at 022-68446529, available from Mon-Sat from 10 AM to 7 PM (Local charges apply). Do not prefix any country code e.g. +91 or 00.

Our branch offices will provide all the required support to help you during the claim settlement process. Details of the HDFC Life branches and representatives are given below:

Branch Name |

Branch Address |

Nodal Officer* |

Contact Number |

Vijayawada |

HDFC Life Insurance, Dno. 38-8-45 MG Road,Opp All India Radio Station,Labbipet, Above Passport office, Vijayawada-520010 |

P Mahaboob Subhani |

9666877796 |

Khammam |

HDFC life Insurance, 1st floor, KSN Mansion, VDO colony, Beside Haveli Restaurant, Khammam- 507002 |

Badde Pullaiah |

9533376268 |

*The nodal officer would be available from 10:00 AM to 6:00 PM (Working Days).

2024 Wayanad landslides

We share our heartfelt condolences for the lives lost and sincere wishes for a speedy recovery of those injured.

We have relaxed the claim intimation guidelines for 2024 Wayanad landslides victims and process the same on priority to help them to tide over the tough time they face.

Please find the list of documents required for claim processing:

Written Death Intimation by the Claimant

Attested death certificate issued by Local Government, Police or Hospital

Identity & residence proof of Claimant

Copy of bank pass book / Cancelled cheque leaf of the nominee for the NEFT purpose

For any further assistance,

Please write to us at: service@hdfclife.com

Or call us at 022-68446529, available from Mon-Sat from 10 AM to 7 PM (Local charges apply). Do not prefix any country code e.g. +91 or 00.

Our branch offices will provide all the required support to help you during the claim settlement process. Details of the HDFC Life branches and representatives are given below:

Branch Name |

Branch Address |

Nodal Officer* |

Contact Number |

Calicut Branch |

Ground Floor, Royal Plaza,Main Road, Gudalai, Kalpetta, 673121, Kerala ---------------------------------------- CM Mathew Brothers Arcade, Eranhipalam PO, Calicut - 673006, Kerala

|

Anoop Parakkandy |

9746559974 |

*The nodal officer would be available from 10:00 AM to 6:00 PM (Working Days).

2024 West Bengal train collision

West Bengal Train collision 2024

We share our heartfelt condolences for the lives lost and sincere wishes for a speedy recovery of those injured.

We have relaxed the claim intimation guidelines for West Bengal train collision victims and process the same on priority to help them to tide over the tough time they face.

Please find the list of documents required for claim processing:

Written Death Intimation by the Claimant

Attested death certificate issued by Local Government, Police or Hospital

Identity & residence proof of Claimant

Copy of bank pass book / Cancelled cheque leaf of the nominee for the NEFT purpose

For any further assistance,

Please write to us at: service@hdfclife.com

Or call us at 022-68446529, available from Mon-Sat from 10 AM to 7 PM (Local charges apply). Do not prefix any country code e.g. +91 or 00.

Our branch offices will provide all the required support to help you during the claim settlement process. Details of the HDFC Life branches and representatives are given below:

Branch Name |

Branch Address |

Nodal Officer* |

Contact Number |

Siliguri - Saharan house |

HDFC Life insurance co Ltd,1st & 2nd Floor ,Saharan House,Sevoke Road,Above ICICI Bank,Siliguri-734001 |

Qaiser Chaudhury |

7797548833 |

*The nodal officer would be available from 10:00 AM to 6:00 PM (Working Days).

Cyclone Remal and subsequent heavy rains/floods

We share our heartfelt condolences for the lives lost and sincere wishes for a speedy recovery of those injured.

We have relaxed the claim intimation guidelines for Remal Cyclone & subsequent Heavy rains/Floods victims and process the same on priority to help them to tide over the tough time they face.

Please find the list of documents required for claim processing:

- Written Death Intimation by the Claimant

- Attested death certificate issued by Local Government, Police or Hospital (Shall be waived in case name of deceased matches published list by State/Central Government or appropriate/Govt. authorities)

- Identity & residence proof of Claimant

- Copy of bank pass book / Cancelled cheque leaf of the nominee for the NEFT purpose

For any further assistance,

- Please write to us at: service@hdfclife.com

- Or call us at 022-68446529, available from Mon-Sat from 10 AM to 7 PM (Local charges apply). Do not prefix any country code e.g. +91 or 00.

Our branch offices will provide all the required support to help you during the claim settlement process. Details of the HDFC Life branches and representatives are given below:

State Name |

Nodal Officers* |

Contact Number |

Assam Meghalaya Nagaland Manipur Mizoram Tripura |

Juri Hazarika |

9864212774 |

West Bengal |

Subhas Gayen |

9733575808 |

Branch Name |

Branch Address |

District Heads |

Contact Number |

Agartala |

Store Ratings. 4.2. View all Reviews · RMS Chowmuhani · 3rd Floor, GRS Tower, AT Road RMS Chowmuhani Agartala - 799001 |

Sanjoy Malakar |

9862209221 |

Aizawl |

3rd Flr, Kelvi International, Bara Bazar, Dawrpui, Aizawl, Mizoram 796001 |

Jonathan Lalnunpuia |

9436155057 |

Contai |

1st Floor, Ward No 2 Mechda Bypass Road, Serpur Etwaribar, above UTI Bank, Contai, West Bengal 721401 |

Soumen Maity |

9932347658 |

Haldia |

1st Flr, Akash Ganga Comm Cplx Durga Chowk, Vasudevpur Nr Manjushree Cinema Hall, West Bengal 721602 |

Soumen Barik |

7908807347 |

Imphal |

HN 10,1st Flr RIMS Rd, DM College Colony, Thangmeiband Nr LML Showroom, Imphal, Manipur 795001 |

Irengbam Shaktichandra Singh |

7005676773 |

Kharagpur |

4th Floor, ATWALS, Real Estate, O T Rd, College More, Kharagpur, West Bengal 721305 |

Abhijit Chakrabarty |

7872300999 |

Kolkata - Barasat |

3rd Floor Dak Bunglow More, 8, Jessore Rd, Barasat, Kolkata, West Bengal 700124 |

Sandipan Dalal |

8777207936 |

Kolkata - Shyam Bazar |

1st & 2nd Floor, Building, 123, Bidhan Sarani Rd, above NIIT, Shyam Bazar, Kolkata, West Bengal 700004 |

Arindam Karmakar |

9874523354 |

Shillong |

HDFC Life · European Ward · 74/105, 1st Floor, RPG Complex, Keating Road European Ward Shillong - 793001 |

Sanjay Chetri |

9862041449 |

Silchar |

Shyama Prasad Rd 1st Floor, Shyama Prasad Rd, Silchar - 788001 |

Moumita Paul |

9864282973 |

*The nodal officers & District Heads would be available from 10:00 AM to 6:00 PM (Working Days).

Cyclone Michaung and subsequent heavy rains/floods

We share our heartfelt condolences for the lives lost and sincere wishes for a speedy recovery of those injured.

We have relaxed the claim intimation guidelines for Michaung Cyclone & subsequent Heavy rains/Floods victims and process the same on priority to help them to tide over the tough time they face.

Please find the list of documents required for claim processing:

- Written Death Intimation by the Claimant/ Nominee

- Attested death certificate issued by Local Government, Police or Hospital

- Identity & residence proof of Nominee or Beneficiary

- Copy of bank pass book / Cancelled cheque leaf of the nominee for the NEFT purpose

For any further assistance,

- Please write to us at: service@hdfclife.com

- Or call us at 022-68446529, available from Mon-Sat from 10 AM to 7 PM (Local charges apply). Do not prefix any country code e.g. +91 or 00.

Our branch offices will provide all the required support to help you during the claim settlement process. Details of the HDFC Life branches and representatives are given below:

Branch Name |

Branch Address |

Nodal Officers* |

Contact Number |

Chennai - T Nagar |

HDFC Life Insurance Company Limited, |

Padmanaban K |

9566540478 |

*The nodal officers would be available from 10:00 AM to 6:00 PM (Working Days).

Odisha Train Tragedy

We share our heartfelt condolences for the lives lost and sincere wishes for a speedy recovery of those injured.

We have relaxed the claim intimation guidelines for Odisha Train Tragedy victims and process the same on priority to help them to tide over the tough time they face.

Please find the process detailed below:

- Written Death Intimation by the claimant/ nominee

- Submit the attested death certificate issued by Local Government, Police or Hospital

- Submit the Identity & residence proof of Nominee or Beneficiary

- Copy of bank pass book / Cancelled cheque leaf of the nominee for the NEFT purpose

For any further assistance,

- Please write to us at: service@hdfclife.com

- Or call us at 2268446529, available between 10am to 6 pm ,Monday to Saturday (Local charges apply).

Our branch offices will provide all the required support to help you during the claim settlement process. Details of the HDFC Life branches and representatives are given below:

Branch Name |

Branch Address |

Nodal Officers* |

Contact Number |

Cuttack |

HDFC Life, 2nd Floor, Royal Tower, Link Road Square, Madhupatna, Cuttack, Odisha - 753010 |

Rakesh Patnaik |

9938712838 |

Kolkata-Menaka Estate |

HDFC Life, Ground and 1st Floor, 3 Red Cross Place, Near Governor House, Kolkata- 700001, West Bengal |

Debasish Pal |

9874432272 |

*The nodal officers would be available from 10:00 AM to 6:00 PM (Working Days).

| Settlement of claims in respect of Train Accident victims: Accident happened at Orissa State on 02.06.2023 | |||||||||

| HDFC Life Insurance Company Limited | |||||||||

| As on : 10.12.2023 | |||||||||

| Sl.No | Type of Claim | Claims reported | Claims settled | Claims Outstanding | Remarks | ||||

| Number | Amount (in lacs) | Number | Amount (in lacs) | Number | Amount (in lacs) | ||||

| 1 | Individual Insurance | Death claims (including rider benefit if any) | NIL | NIL | NIL | NIL | NIL | NIL | |

| 2 | PMJJBY | Death Claims | NIL | NIL | NIL | NIL | NIL | NIL | |

| 3 | Personal Accident(Other than PMSBY) | NIL | NIL | NIL | NIL | NIL | NIL | ||

| 4 | Health Claims | NIL | NIL | NIL | NIL | NIL | NIL | ||

| 5 | All Other Miscellaneous | NIL | NIL | NIL | NIL | NIL | NIL | ||

Claim at Branch

![before]()

Download & fill up

claim form![after]()

![before]()

Collect all the required

supporting claim documents![after]()

![before]()

Submit claim form and

supporting documents

Search results for "Tamilnadu" State

Location

Map

INT/CL/11/22/30135

Pradhan Mantri Jeevan Jyoti Bima Yojana Claim Process Flow

- Pradhan Mantri Jeevan Jyoti Bima Yojana Claim Process Flow

Pradhan Mantri Jeevan Jyoti Bima Yojana Claim Process Flow

-

![before]()

Nominee to approach the Bank wherein the Member was having the ‘Savings Bank Account’ through which he / she was covered under PMJJBY; long with the death certificate of the member.

![after]()

-

![before]()

Nominee to collect Claim Form, and Discharge receipt, from the Bank or any other designated source like insurance company branches, hospitals, PHCs, BCs, insurance agents etc., including from designated websites. The insurance companies concerned shall ensure wide availability of forms at all such locations. Supply of the form shall not be denied to any person requesting the same.

![after]()

-

![before]()

Nominee to submit duly completed Claim Form, Discharge Receipt, death certificate along with photocopy of the cancelled cheque of the nominee’s bank account (if available) or the bank account details to the Bank wherein the Member was having the ‘Savings Bank Account’ through which he / she was covered under PMJJBY.

Pradhan Mantri Jeevan Jyoti Bima Yojana Claim Process Flow

Pradhan Mantri Jeevan Jyoti Bima Yojana Claim Process Flow

Pradhan Mantri Jeevan Jyoti Bima Yojana Claim Process Flow

-

![before]()

Nominee to approach the Bank wherein the Member was having the ‘Savings Bank Account’ through which he / she was covered under PMJJBY; long with the death certificate of the member.

![after]()

-

![before]()

Nominee to collect Claim Form, and Discharge receipt, from the Bank or any other designated source like insurance company branches, hospitals, PHCs, BCs, insurance agents etc., including from designated websites. The insurance companies concerned shall ensure wide availability of forms at all such locations. Supply of the form shall not be denied to any person requesting the same.

![after]()

-

![before]()

Nominee to submit duly completed Claim Form, Discharge Receipt, death certificate along with photocopy of the cancelled cheque of the nominee’s bank account (if available) or the bank account details to the Bank wherein the Member was having the ‘Savings Bank Account’ through which he / she was covered under PMJJBY.

Claim at Branch

![before]()

Download & fill up

claim form![after]()

![before]()

Collect all the required

supporting claim documents![after]()

![before]()

Submit claim form and

supporting documents

Search results for "Tamilnadu" State

Location

Map

Watch how to make a life claim online

Quicker, simpler and efficient claim settlement process.

Please enter following details to find your claims status

Claim Track Record

for FY 2024-2025

We have honoured 99.68% Individual Claims!*

At HDFC Life, we ensure a hassle-free and uniquely sensitive claim experience. We are always doing our utmost to enable faster settlement of claims, with our Claim Settlement Ratio reflecting this assurance.

Same Day Claims Processing

Individual claims processed within 24 business hours for all claims over 3 years from the date of inception**

*Individual death claim settlement ratio by number of policies as per audited annual statistics for FY 2024-25.

Know More**Provided we have received all the relevant and required documents and no further investigation is required. Claim settlement process would be completed within stipulated timelines once the claim request is approved.

Know MoreHave a question

We’ll tell you everything you need to know about Claims Process

- Documentation

- Process

- Process for NRIs

- Health

- Cancer Care

- FAQs

- Grievance Mechanism

- Communication to Claimants

A ready reckoner of claims-related information for a

hassle-free settlement experience

What are the documents required to process a death claim?

The documents required to process the claim are based on the cause of death are:

SR. |

DOCUMENT NAME |

NATURAL |

UN-NATURAL |

NATURAL DISASTERS |

i. |

Claims Form * with bank account proof |

✔ |

✔ |

✔ |

ii. |

Death certificate issued by the Government |

✔ |

✔ |

✔ |

iii. |

Claimant’s Photograph |

✔ |

✔ |

✔ |

iv. |

Claimant's Identity & Address proof |

✔ |

✔ |

✔ |

v. |

Original Policy Document |

✔ |

✔ |

✖ |

vi. |

Claimant's PAN CARD/Form 60 (if PAN Card not available) |

✔ |

✔ |

✔ |

vii. |

Post Mortem attested by hospital authorities |

✖ |

✔ |

✖ |

viii. |

Medical records for diagnosis and treatments |

✔ |

✖ |

✖ |

ix. |

Doctor’s / Hospital’s certificate (Form)* |

✔ |

✖ |

✖ |

x. |

Employer’s certificate (Form)* if employed |

✔ |

✔ |

✖ |

xi. |

Police records attested by police authorities |

✖ |

✔ |

✖ |

Note✔ : Required Documents

✖ : Documents Not Required

- Unnatural cause would mean Accidental / Murder / Suicide.

- Any document submitted in photocopy needs to be Originally Seen and Verified by HDFC Life employee.

- * All the required forms are available on our website in “Download Form” tab under the following link - http://www.hdfclife.com/claims

- Documents (i – iv) are only required where claims are submitted under following products - Pension Plans, Single Premium Whole of Life, Savings Assurance Plan, Immediate Annuity Plan.

- Original Policy document will not be required for Group Claims.

- HDFC Life may call for documents apart from the above (case specific).

- Physical version of the electronic insurance policies need not be submitted by customers when electronic insurance policies are issued through the platform of registered Insurance Repositories.

What are the documents required for Critical Illness Claim?

- Critical Illness claim form with bank account proof

- Medical records viz. reports of diagnostic tests, hospital and treatment records for illness diagnosed

- Original Policy Document

- Claimant's PAN card and address proof

Which account proofs can be submitted?

For Death claim, Original cancelled personalized cheque or original bank statement with pre-printed Account Number, IFSC code and Beneficiary’s name

For Critical Illness claim, Original cancelled personalized cheque or original bank statement with pre-printed Account Number, IFSC code and Life Assured’s name

What needs to be done if the Policy documents are not available with the Nominee?

- An Indemnity Bond should be submitted in lieu of Policy document which is lost. The indemnity needs to be executed on the stamp paper and duly notarized. The value of the stamp paper would be as applicable in the state.

- The template for indemnity bond is available on our website in “FORMS & DOWNLOAD” section under Customer Service >Quicklinks> FORMS & DOWNLOAD>

Policy Servicing Request Forms.

What is the Grievance mechanism available, if Im not satisfied with the claims decision?

The customer can contact us on the below mentioned address in case of any complaint/ grievance:

Grievance Redressal Officer

HDFC Life Insurance Company Limited,

12th Floor, Lodha Excelus,

Apollo Mills Compound, N .M. Joshi Road,

Mahalaxmi, Maharashtra, Mumbai - 400 011

Helpline number: 022-68446530 (Local charges apply)

E-mail: service@hdfclife.com

In case you are dissatisfied with our service, we have in place an internal mechanism to ensure effective and timely resolution of your complaints. You can view our grievance redressal link here

If you are still not satisfied with the response provided by the Claims Review Committee, you could also approach the Insurance Ombudsman in your region

How will I know that a claim is registered?

- HDFC Life will send an acknowledgement letter within 15 days of receiving the documents.

- In case there are any further requirements the same will be intimated via this letter, e-mail on your registered address and SMS on your registered mobile number.

What if the NEFT payment made by HDFC Life is rejected by the bank?

- A letter will be sent to the claimant informing them of the NEFT failure.

- The payment will be processed on receipt of the fresh NEFT mandate along with the account proof.

If a claim is rejected, then how will the same be communicated?

HDFC Life will send a detailed rejection letter within 10 days of decision including the reason for the rejection of the claim.

ARN: PP/08/22/28415