11 Best Child Investment Plans Options

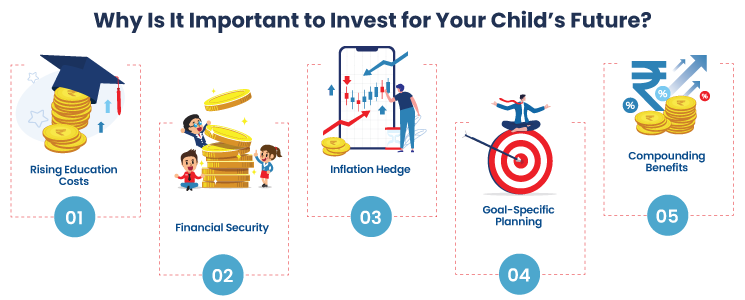

Whether you are looking to secure your child's education or protect your finances from the impact of inflation, investing early is key. It enables you to create wealth systematically. So, some of the best child investment plans in India that you can consider are discussed below:

Unit-Linked Insurance Plans (ULIPs)

ULIPs are among the best child investment plans as they provide the dual advantages of life insurance and investment. They help you create wealth to cover long-term goals such as your children’s higher education and marriage.

Among the 2-part premiums paid towards ULIPs, one part ensures life insurance coverage, and the other part gets invested in various market-linked funds of your preference.

Here are some of its features:

● Flexibility to personalize investments based on your risk appetite.

● Partial withdrawal or liquidity helps to handle immediate expenses.

● Assists in goal-based planning, such as wealth generation or retirement planning.

● Tax deductions are applicable under Section 80C of the Income Tax Act, 19612 on premiums paid subject to the prescribed overall limit of Rs. 1, 50, 000

● Tax-free switching between equity and debt funds.

● Starting to invest in ULIPs early can maximize returns.

● Maturity amount from ULIPs may become tax-free under Section 10(10D) of the Income Tax Act, 1961 subjected to conditions prescribed.

● Death benefits are completely exempted from tax under Section 10(10D) of the Income Tax Act, 1961.

Life Insurance

Traditional life insurance plans like endowment plan or whole-life policies provide guaranteed payouts either on maturity or in case of the policyholder’s death. These ensure the child’s needs are met without financial strain, offering safety and predictable returns.

Here are some of its features:

● The maturity benefit provides a lump sum that secures a child’s future. You can use a lumpsum calculator to estimate how this lump sum could grow over time and help with long-term planning.

● Flexibility to pay the premium on a monthly, quarterly, half-yearly and annual basis.

● Beneficiaries receive the sum assured as a death benefit.

● The lump sum received ensures the family’s financial requirements are met.

● Premiums are tax-deductible up to ₹1.5 Lakh under section 80C of the Income Tax Act, 19612

● A traditional life insurance plan, such as an endowment, provides life cover as well as a maturity benefit.

● It is completely safe and promises guaranteed returns.

Similar to ULIPs, IRDAI ensures that the life insurance plans offered by insurers are free from ambiguity and financially sound.

Systematic Investment Plans (SIPs)

SIPs are such investment plans for children that let parents invest fixed amounts regularly in mutual funds, enabling disciplined saving for long-term goals like education. They benefit from rupee cost averaging, compounding, and flexibility, with child-specific SIPs or equity funds offering better inflation-adjusted returns.

Features that make SIPs a perfect child investment plan is:

● Small, regular investments that grow your wealth through compounding over time.

● You can start SIP with a minimum of ₹500, and the tenure can be for 10 to 15 years.

● Based on your risk tolerance, you can choose between equity and hybrid funds.

● Equity fund investments have return potential that can shield against inflation.

● When the children reach 18 years of age, withdrawal of the whole SIP amount supports their child’s education.

● SIPs offer flexibility to start or stop investments.

● Diversification of a portfolio is possible through investing in multiple funds.

● Investment in Equity linked saving Scheme (ELSS) provides the benefit of claiming deduction up to ₹1.5 Lakh under section 80C of the Income Tax Act, 19612

Fixed or Recurring Deposits

Fixed Deposits (FDs) and Recurring Deposits (RDs) are among the safest child investment options, offering stability, predictable returns, and protection from market volatility. Parents who are looking for the best investment plan for 5 years for their kids, both FDs and RDs provide excellent options to build a secure corpus for education, marriage, or emergencies but, they differ in deposit structure:

● FDs: A lump-sum investment for a fixed tenure.

● RDs: Small, regular monthly deposits over a chosen period.

Here are some features of fixed deposits:

● Ideal for creating long-term security and even a financial legacy.

● Encourages financial discipline when explained to children.

● Tenure ranges from 7 days to 10 years.

● Early withdrawal allowed with minimal penalty.

● Loan facility up to 90% of the FD value.

● Interest rates: 2.50%–8.50%.

● Section 80TTA of the income tax act, 1961 provide a deduction of up to Rs 10,000 on the income earned from interest on fixed deposits made in bank, co-operative society, post office.

Here are some features of recurring deposits:

● Monthly deposits starting from ₹500.

● Tenure ranges from 6 months to 10 years.

● Builds disciplined saving habits; penalties apply for late payments.

● Interest rates: 2.50%–8.50%.

Both FDs and RDs ensure steady growth, making them reliable tools for child investment plans in India to secure their future.

Sukanya Samriddhi Yojana

A government-backed savings scheme for the girl child, it offers high interest rates (reviewed quarterly), tax exemption under Section 80C of the Income Tax Act, 19612, and maturity at age 21. The scheme is part of the Beti Bachao Beti Padhao campaign. Families with a girl child prefer this scheme since, besides incentives, it offers triple tax benefits. Also, early account opening maximises benefits.

Features include:

● When a girl child reaches the age of 10, her parents can open an account in her name.

● The interest amount for this scheme is 8.2% per annum.

● The minimum amount to start the scheme is ₹250, and the maximum is ₹1.5 Lakh.

● The maturity benefit can be availed from 21 years of age.

● Under section 80C of the Income Tax Act, 19612, the deposited amount under the scheme is eligible for tax deduction up to ₹1.5 Lakh.

● Withdrawal is allowed only for educational purposes.

● The returns from this scheme are tax free.

Gold

Gold is a traditional investment that holds value and acts as an inflation hedge. You get options like gold exchange-traded funds (ETFs), gold mutual funds, sovereign gold bonds or physical gold in the form of bars or jewellery.

Not only does it have high liquidity, but it also has the power to protect against inflation. This is why it is considered one of the best child investment plans in India.

Here are some reasons to consider gold as your children's investment plan:

● One of the oldest and traditional investment options.

● Offers safety, security, liquidity and profitable returns.

● Returns from gold are proven to be an ideal hedge against inflation.

● A fixed interest rate of 2.5% semi-annually is gained from sovereign gold bonds.

● During the maturity of a gold bond, the amount can be redeemed in INR (₹).

Public Provident Fund (PPF)

PPF is a government-backed savings scheme, making it one of the safest child investment options. It not only offers fixed, guaranteed returns but also comes with EEE tax status, meaning tax exemption on deposits, interest earned, and maturity amount. This triple benefit makes it highly attractive for long-term child financial planning.

Key features include:

● Deposit Range: ₹500 to ₹1.5 lakh per financial year.

● Interest Rate: 7.1% for FY 2025–26.

● Tenure: 15 years, extendable by 5 years.

● Liquidity: Partial withdrawals allowed after 5 years in emergencies.

● Loan Facility: Option to avail loans against your PPF balance.

● PPF’s stability and tax efficiency make it a reliable cornerstone for a child’s future fund.

● PPF contribution are eligible for deduction under Section 80C , interest earned on investment is tax-free and maturity is also tax-free.

Bonds

Bonds are fixed-income instruments issued by the government, public sector units (PSUs), local authorities, or corporations. This investment plan for a child offers predictable interest income with relatively lower risk than equities, making it a suitable choice for parents aiming to fund specific child milestones like higher education or marriage. Government-backed bonds, such as RBI Floating Rate Savings Bonds or Sovereign Gold Bonds, provide added security and reliability.

Key features are:

● Issued by government, PSUs, or private companies.

● Maturity ranges from a few months to several years.

● Choice of tenure, like short, medium, or long-term.

● Periodic interest payouts for steady income.

● RBI Floating Rate Bonds currently offer - 8.05% (paid every 6 months).

● Certain PSU-issued tax-free bonds provide interest income without tax liability.

Real Estate

Real estate is a long-term, high-commitment investment option that can significantly contribute to a child’s future when planned wisely. Properties in prime locations often appreciate in value over time, making them reliable assets. Additionally, rental income can provide consistent passive earnings, helping parents meet certain financial needs.

Key points to understand about this best child investment plan are:

● Value Appreciation: Well-located properties tend to grow steadily in worth.

● Passive Income: Rental earnings offer regular cash flow.

● Generational Wealth: Assets can be passed down to secure future generations.

However, due to its illiquidity and high initial cost, real estate should be considered a supplementary rather than primary tool for child-specific financial goals.

Mutual Funds

Mutual funds are pooled investment vehicles where investors’ money is combined and managed by professionals to achieve diversified growth. Parents can choose from flexible options such as child gift funds, balanced funds, debt funds, equity-oriented funds, and tax-saving ELSS.

Unlike SIPs, which refer to the mode of regular investment, mutual funds represent the overall scheme you invest in.

Here are its features to consider:

● Professional Management: Expert fund managers handle investments for balanced, goal-driven growth.

● Diversification: Spreads risk across different asset classes.

● Growth Potential: Compounding and reinvestment can significantly boost wealth.

● Taxation: Equity funds are taxed at 12.5%; debt fund tax varies.

● NAV-Based Returns: Fund value depends on the performance of underlying assets.

This approach lets parents match investments to their risk appetite and goal duration.

Debt Funds

Debt mutual funds primarily allow an investor to invest in assets that offer fixed income, such as government securities, corporate bonds, treasury bills and so on. These funds come with a stable and predictable income option, making them reliable investment options for parents.

Features that make debt funds one of the best child investment plans include:

● Less risk compared to equity funds makes these funds ideal for medium-term goals.

● Offer easy liquidity so parents can withdraw the amount whenever necessary.

● Relatively stable investment option.

● Provide regular income in the form of interest or dividends.

Suitable for parents looking for tax-efficient returns.

Show Less