What do you want to do?

- Retirement and Pension Plans

- What are Retirement and Pension Plans?

- How Do Pension Plans Work?

- Why do I need to plan for my retirement?

- Why do you need retirement plans in India?

- Why Should You Invest in Retirement Plans Now?

- Start Your Retirement Plan Now and Retire on Your Own Terms

- What are the features of Retirement Plans in India?

- Who Should Consider Buying a Retirement Plan

- Top Retirement and Pension Plans in India 2026 by HDFC Life

- Secure Your Retirement with the Right Pension and Annuity Plans

- HDFC Life QROPS

- Retirement/Pension Calculator

- How to Calculate the Return on a Pension Scheme?

- What are the factors to consider while buying a pension plan in India?

- Know more about riders

- How Much Do I Need to Retire?

- What are the Steps to Buy a Retirement Plan?

- 3 Reasons You Need To Start Your Retirement Planning Today

- Eligibility Criteria for Retirement Plans

- Documents Required to Buy a Pension Plan in India

- FAQ on Retirement Plans

- Talk to an Advisor

- Key Highlights

- Articles on Retirement

- Popular Searches

What are Retirement and Pension Plans?

Retirement plan is a form of life insurance plan that is designed to provide income and financial security after retirement.

Retirement plan refers to any strategic financial arrangement made by an individual to gather funds for their post-employment years. The primary objective of a retirement plan is to help an individual achieve financial freedom after retirement.

Pension plan is a specific type of retirement plan (offered by employers through government schemes or as individual pension plans) that provides a predefined regular income (known as pension) post-retirement in exchange for regular investments in a pension fund. The predefined regular income or payout is provided through the purchase of annuity plans once the retirement corpus has been accumulated in a pension plan.

...Read More

How Do Pension Plans Work?

Pension plans in India are designed to help you build a corpus while you are working to ensure that you get a steady stream of income after your retirement. Pension plans have two phases:

Accumulation phase :

During the accumulation phase, you need to regularly invest in a pension plan. Your investments will compound over time and grow to build your corpus.

Vesting phase :

Once you reach your predefined retirement age (e.g., 60 years), also known as the vesting age, you will start receiving a regular pension annuity from your accumulated corpus.

Let’s understand how different types of pension plans work in India:

Government-Backed Pension Schemes

These are popular for their steady returns, making them suitable for individuals seeking a low-risk retirement plan.

a. Employees’ Provident Fund (EPF)

How it works: This is a compulsory pension plan for salaried individuals in companies that have 20 or more employees. As per the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 vii both the employee and the employer chip in 12% of the employee’s basic salary and their Dearness Allowance (DA) into the EPF account. 8.33% of the employee’s pensionable salary (with a limit of Rs.15, 000), is directed towards the Employees’ Pension Scheme (EPS), while the rest goes into the EPF.

Benefits: When someone retires or leaves their job, the total corpus (along with the accrued interest) in EPF can be availed. The EPS provides a monthly pension after retirement if the individual has at least 10 years of service and retires at 58. They can get a reduced pension starting at 50. Plus, it offers family benefits, such as a pension for widows or children, if the EPF account holder passes away.

Tax Benefits: Contributions towards EPF are eligible for tax deductions under Section 80C of the Income Tax Act, 1961 vii.

b. National Pension System (NPS)

How it works: National Pension System (NPS) is a voluntary retirement savings scheme for all Indian citizens aged between 18 and 70. Contributions made in the pension account are invested in a mix of equities, debts and government securities. Subscribers of NPS can choose their investment strategy based on their preferred asset allocation or can opt for the ‘auto choice’ option, which adjusts the investment mix as you age.

Flexibility: NPS offers the freedom to choose pension fund managers and scheme option.

Payout: In case of normal exit when the subscribers turn 60, they can withdraw up to 60% of the accumulated corpus as a lump sum. The remaining 40% of the corpus must be used to purchase an annuity plan from an Annuity Service Provider (ASP) to receive a regular pension viii.

Tax Benefits: Contributions are eligible for tax deductions under Section 80CCD(1) (up to 10% of basic pay + DA or upto 20% of Gross Income for self-employed within the ceiling of Rs.1.5 lakh under Section 80CCE) and an additional deduction of upto Rs.50,000 under Section 80CCD(1B). In case the subscribers receive employer contributions they can claim the same for tax deductions under Section 80CCD(2), under the condition of an aggregate limit of Rs.7.5 lakh of contributions made towards NPS, recognised provident fund and approved superannuation fund ix.

c. Atal Pension Yojana (APY):

How it works: Atal Pension Yojana is a government-backed pension scheme introduced for the unorganized sector. APY is applicable for all Indian citizens aged 18 to 40. The subscribers can exit the scheme at 60 and get a monthly pension.

Benefits: Under Atal Pension Yojana the subscriber will get a guaranteed minimum monthly pension between Rs.1000 to Rs. 5000 X

d. Public Provident Fund (PPF):

How it works: PPF can be treated as a pension plan to secure your retirement. PPF is a long-term savings scheme for all Indian citizens with a minimum deposit of Rs.500 per year and a maximum deposit of Rs.1,50,000 per year. A PPF account matures on completion of 15 years xi.

Benefits: PPF offers guaranteed, tax-free returns and is considered a very safe and reliable investment option. The accumulated amount in a PPF can be used for retirement needs. Loan facility can be availed from the 3rd financial year up to the 6th financial year. The withdrawal facility is permissible every year from the 7th financial year.

Tax benefits: Deposits made in a PPF are eligible for tax deductions under Section 80C, and the interest earned and maturity amount are exempted from tax as well.xi

Private Pension Plans (Annuity Plans)

Annuity plans are offered by life insurance companies in India and allows you to convert a lump sum or regular payments into a guaranteed income stream till you live or for a specified period.

How they work :

In an annuity plan, you pay a fixed premium either as a lump sum or through regular contributions to your chosen life insurance provider. In return, the insurer offers you a guaranteed income (annuity) for a specified period or for the rest of your life. This income can start immediately (Immediate Annuity) or after a deferment period (deferred annuity). To estimate your potential payouts and choose the right option, you can use an annuity calculator based on your investment amount and retirement goals.

Types of annuity plans :

You can choose the type of annuity depending on your needs:

- Immediate Annuity Plans: As the name suggests, you pay a lump sum and start receiving a monthly pension immediately

Deferred Annuity Plans: You make payments over a set period (accumulation phase), and then you receive the monthly pension after a chosen deferment period. HDFC Life Smart Pension Plus is a single plan offering both immediate & deferred annuity.

Life Annuity: In this case the pension amount is paid to you for lifetime. You can choose it to be a ‘single life’ (only for you) or ‘joint life’ (for you and your spouse).

Life Annuity with Return of Premium: With this option you will get your pension for life but on your demise your nominee will get back a certain percentage of the paid premiums. With HDFC Life Smart Pension Plus you have the option to avail life annuity with return of percentage of total premiums paid.

Annuity Certain: The pension amount is paid for a guaranteed number of years, even if you pass away. If you die before the end of the guaranteed period, your nominee will receive the remaining pension amount.

Guaranteed Period Annuity: This is similar to annuity certain, but with a specific duration like 5, 10, 15 or 20 years.

Pension Plans with Life Insurance (ULIPs): This pension plans is Unit Linked Insurance Plan (ULIP) that combines the benefits of life insurance and investments. A portion of the premium goes towards providing life cover and the rest is invested in market-linked assets/funds. Returns are strictly dependent on market performance. HDFC Life Smart Pension Plan is a suitable plan, if you want a regular income in your retirement by building the corpus with market linked returns in the accumulation phase. The plan comes with the advantage of life insurance.

Tax Implications: Tax deductions on premiums for private pension plans can be claimed under the Section80C of the Income Tax Act, 1961#.

Choosing the right pension plan depends on your financial goals, risk tolerance, current age & retirement age and employment status. You can use tools like the retirement calculator and consult a financial advisor to determine the most suitable pension plan.

Why do I need to plan for my retirement?

Planning for your retirement is a crucial step for living a stress-free retirement. Here is a breakdown of the reasons for planning for retirement -

Financial freedom

Address rising expenses

Longer life expectancy

Once you stop working, you won’t have a salary to depend on. Planning your retirement (during your working years) will help you generate a steady income source to manage your expenses post-retirement without relying on your children and government support. Having a robust retirement plan in place will also give you peace of mind, knowing you have financial support once you have stopped earning.

Due to rising inflation, the purchasing power of money will reduce overtime. A well-planned retirement enables you to grow your wealth and save to beat inflation and meet your expenses after retirement. A major cost in old age is medical expenses, which are also rising due to inflation. Planning your retirement will ensure that you are prepared for healthcare costs like doctor consultation fees and medicines when the need arises.

With advancements in medical science, we are expected to live longer lives. India’s life expectancy in 2025 is 70.82 years, which is good news, but it means that your retired life could last 20 or 30 years^. In the absence of an accumulated corpus or a steady pension, it will put you at financial risk during retirement.

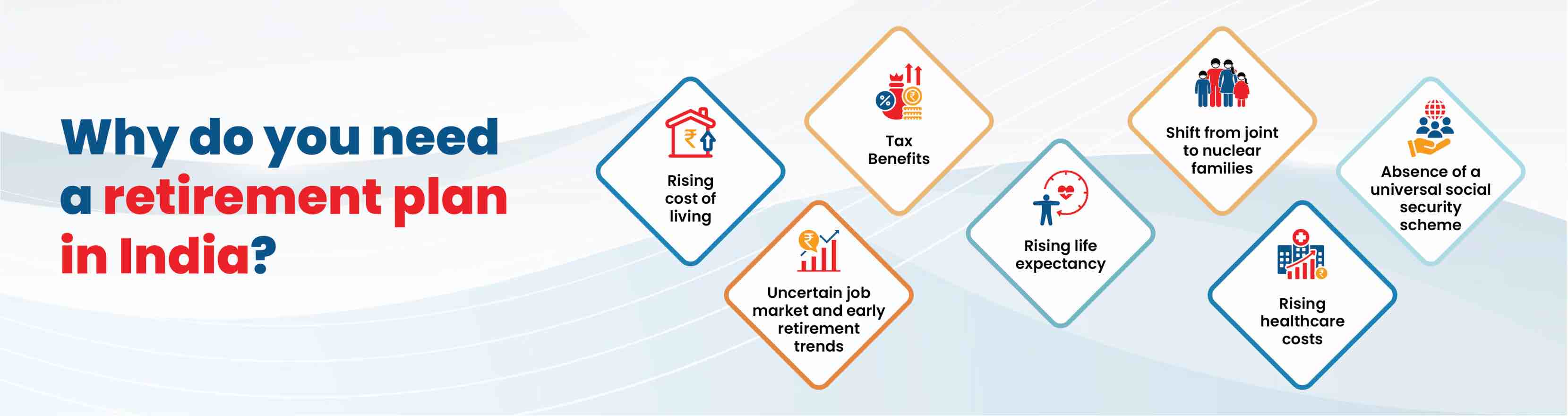

Why do you need retirement plans in India?

In India, it is very important to plan your retirement due to rising inflation, changes in family dynamics, and the absence of any social security scheme. Here are the reasons why you need retirement plans:

Uncertain job market and early retirement trends

The rise in unexpected layoff and health issues associated with stress and burnout makes Indians consider early retirement. As stated by Zerodha co-founder Nikhil Kamath, “Retirement isn’t just about money”i. It’s important to consider the financial, emotional, and psychological challenges of early retirement. When it comes to the financial aspect of retiring early, you should have an adequate retirement corpus, ensuring peace of mind if you stop working before 60 years. In your objective to build an adequate corpus, you should choose the best retirement plan as per your financial needs and current age.

...Read More

Rising healthcare costs

Healthcare costs in India is projected to increase by 13% in 2025 as per Aon’s Global Medical Trend Rates Report 2025ii. Without employer healthcare after your retirement you will need funds to cover your medical expenses. Although individual health insurance will help cover major expenses, you will need some funds to manage the associated medical costs of any illness and long-term care. A retirement or pension plan can provide monthly income to help you with such costs.

...Read More

Rising life expectancy

India’s life expectancy for 2025 is 70.82iii and has been on the increasing trend for more than a decade. The life expectancy in India can be expected to increase further with improved living and healthcare standards. Rising life expectancy poses the question - whether you have adequate corpus to maintain your standard of living after retirement? As per the 4th edition of India Retirement Index Study 57% Urban Indians believe that their retirement savings will exhaust in only 10 years into their retirement iv. A retirement plan with an objective to build corpus in the long-term will help ensure that you have sufficient funds to cater to your financial needs long after retirement.

...Read More

Rising cost of living

Inflation gradually increases the cost of goods and services, which means your current savings may not be enough in the future. As per the Government of India (Ministry of Finance) the retail inflation in India as measured by Consumer Price Index (CPI) stood at 4.6% in the fiscal year 2024-25 v. Through planned investments in retirement plans, you can increase your wealth and maintain your level of life even as costs rise. By preparing in advance, you can avoid financial strain and ensure that you can afford both essential and discretionary expenses post-retirement.

...Read More

Attractive Tax benefits

Retirement plans such as the Public Provident Fund (PPF), National Pension System (NPS), Employees' Provident Fund (EPF) and life insurance plans provide tax deductions under Section 80C#,Section 80CCD# and Section 10(10D)# of the Income Tax Act, helping you reduce tax burdens while saving for your retirement.

...Read More

Shift from joint to nuclear families

Traditionally Indian retirees relied on their children for financial support. But that has changed with nuclear families now accounting for a substantial majority of households, with the Report on Indian Hyperlocal Commerce Opportunity by Redseer estimating nearly 67-70% by 2028 vi. With this rise in nuclear families, it’s crucial to prepare for financial self-reliance with the help of a long-term investment strategy in a retirement plan.

...Read More

Absence of a universal social security scheme

India lacks a robust government-funded pension system for all citizens. Most citizens need to rely on personal savings, employer-sponsored schemes, or private retirement plans to fund their post-retirement life.

...Read More

Why Should You Invest in Retirement Plans Now?

Regardless of your age, investing in a retirement plan is a crucial step in your financial planning. Here are some reasons why you should start investing in a retirement plan at the earliest:

Power of compounding

The power of compounding is the biggest advantage of starting your retirement planning early. At the beginning, even if you are starting with a small amount of investment, it will help you to take advantage of compounding if you stay consistent and gradually increase your investment later on. In simple terms with the power of compounding your investments will generate returns and then those returns will generate further returns.

For example, someone starting at the age of 25 by investing Rs.5, 000 per month at 8% per year could have Rs.1.15 crore by the age of 60 years. If they wait till the age of 35 years to start, the corpus would drop to only Rs.47.87 lakh. You can use the compound interest calculator to check your returns.

...Read More

Attractive tax benefits

The Indian Government offer tax saving benefits on government backed retirement plans such as NPS, PPF, EPF and others to encourage saving for your retirement. You can also avail tax benefits on private life insurance based retirement plans as well.

...Read More

Financial independence

Having a retirement corpus in place gives you the peace of mind and confidence to retire on your terms. The accumulated funds through a retirement plan allow you to maintain your standard of living and pursue your hobbies & goals with complete financial independence.

...Read More

Recover from market volatility

Starting early in your journey of retirement planning will give you enough time to ride out the uncertainties of the markets. When it comes to retirement planning having a longer horizon for your investments gives you the opportunity to recover from market downturns in the long run. As per Funds India, Indian equities have given 15% returns over 20 years xii.

...Read More

Increasing life expectancy and health care costs

India’s life expectancy is steadily increasing. This means that your retirement period will be longer than your parents thus requiring a larger corpus.

Healthcare costs are also rising in India due to inflation often faster than the retail inflation. One of the major expenses during retirement is medical costs, thus starting early gives you time to accumulate enough funds for unexpected expenses reducing the financial burden on your family.

...Read More

Lack of social security and declining family support systems

Unfortunately, India lacks a universal government social security scheme; thus, it’s crucial we start investing in a suitable retirement plan at the earliest. There are multiple types of retirement plans offered by the government and private companies to suit different financial goals and retirement needs.

Traditionally, joint families in India provide financial support for their elders, but that is weakening due to the increasing nuclear families and migration to cities.

...Read More

What are the features of Retirement Plans in India?

Retirement plans in India have various features that help individuals secure their financial needs post-retirement. Features depend on the type of retirement plan such as government backed schemes, annuity plans and life insurance based options. Here are the common features in retirement plans:

Long-Term Savings

Regular Income Post-Retirement

Tax Benefits

Vesting Age

Nomination Facility

Flexibility

Life Insurance

The Primary objective of retirement plans is to build a handsome corpus over the long-term (till the time you retire) in a sustained manner.

Retirement plans provide a steady and reliable source of income after retirement, either in the form of a monthly pension (annuity) or a lump sum amount.

Tax exemptions are a significant advantage offered by most retirement plans in India. Contributions made, interest earned and withdrawal amounts are often eligible for tax deductions under various sections of the Income Tax Act, 1961.

This is the age at which you start receiving your pension payouts. The age varies as per the retirement plan but usually its 60 years.

In retirement plans you have the option to nominate your beneficiary. In case of your death your nominee will receive the accumulated fund or the monthly pension amount.

Although retirement plans are long-term investments and you should invest in a disciplined manner, many plans offer flexibility in terms of vesting age, investment frequency (monthly, quarterly, annually or lump sum), investment choices/asset allocations (for market-linked plans), and withdrawal options in case of emergency. For example, HDFC Life Smart Pension Plan provides the flexibility to change the vesting age and premium paying terms.

Life Insurance based retirement plans offer the added benefit of life cover along with the opportunity to invest for retirement needs. HDFC Life Smart Pension Plan provides a life insurance cover to the extent of 105% of the total premiums paid, including top-up premiums.

Who Should Consider Buying a Retirement Plan?

Buying a retirement plan is beneficial for anyone expecting to stop working one day and lack sufficient corpus to sustain their life post retirement. However investing in a retirement planning becomes essential for certain groups during specific life stages:

Young professionals (in 20s & 30s)

Being young gives you the opportunity to start early and take advantage of the power of compounding. Having a longer horizon for investment also gives you the chance to recover from market downturns and build a habit of investment. At a younger age premiums of retirement plans with life insurance are lesser.

...Read More

Self-employed individuals and business owners

Self-employed people are solely responsible for their financial future in the absence of employer-sponsored retirement benefits. Building a solid corpus is facilitated by disciplined investing through retirement plans and consistent deposits. They may protect their lifestyle and have financial freedom in their golden years by starting early and continuing to make contributions, which will guarantee they have enough money after retirement.

...Read More

Mid-Career Professionals (in 30s & 40s)

The middle of your career is a critical time to evaluate and improve your retirement funds. Professionals can boost their contributions with increased income to take advantage of compounding. In order to guarantee a stress-free retirement later in life, this stage provides an excellent chance to make up for lost savings. As per the Outlook Money – Toluna Retirement Survey conducted in December-end 2023, 79 per cent of respondents in the age group of 30-39 years have started planning for their retirement xiii.

...Read More

Pre-Retirees (in 50s)

Even for those close to retirement, it is not too late to plan effectively. By focusing on lower-risk, stable-return retirement plans, pre-retirees can still accumulate meaningful funds. Choosing the right products and strategies tailored to shorter horizons can help secure steady post-retirement income and safeguard financial independence during retirement. As per the Outlook Money – Toluna Retirement Survey conducted in December-end 2023, 67 per cent in the age group of 50-59 years have started planning for their retirement.

...Read More

Women

As per World Bank collection of development indicators, compiled from officially recognized sources, females in India have a life expectancy of 73.6 years which is higher than that of men xv. Thus, requiring a larger retirement corpus to sustain their standard of living post retirement. Also, with changing dynamics women should have financial independence post retirement rather than depending on their spouse or family.

...Read More

Anyone seeking financial independence and peace of mind

An early start with a robust retirement plan will help you accumulate the required corpus to:

- Maintain your standard of living

- Combat inflation

- Cover healthcare expenses

- Fulfil your retirement goals

- Avoid financial dependency on your children or family

...Read More

Top Retirement and Pension Plans in India 2026 by HDFC Life

Explore HDFC Life's pension plans with life insurance benefits. Compare key features like return types and minimum investments to find your ideal plan.

HDFC Life Retirement/Pension Plans |

Type of Return |

Entry Age |

Maturity Age |

Policy term |

Minimum amount to Invest (Annually) |

Action |

HDFC Life Click 2 Retire |

Market Linked Returns |

18-65 years |

45-75 years |

10-35 years |

₹ 24,000 |

|

HDFC Life Smart Pension Plan |

Market Linked Returns |

18–70 years |

40-80 years |

5-55 years |

₹ 30,000 |

|

HDFC Life Sanchay Aajeevan Guaranteed Advantage Plan |

100% Guaranteed1 Returns |

18-70 years |

40-80 years |

5-30 years |

₹ 30,000 |

|

HDFC Life Guaranteed Pension Plan |

100% Guaranteed1 Returns |

18-70 years |

40-80 years |

8-40 years |

₹ 5000 – No limit |

|

HDFC Life Systematic Pension Plan |

Assured Benefit^ |

18-70 years |

40-80 years |

5-40 years |

₹ 30,000 |

NOTE – [HDFC Life Smart Pension Plan, HDFC Life Click 2 Retire]

In this policy, the investment risks in the investment portfolio is borne by the policyholder

Secure Your Retirement with the Right Pension and Annuity Plans

Guarantee yourself a steady source of income for life by investing lumpsum in HDFC Life annuity plans.

You should go for these, if you:

- Have a substantial lumpsum amount / corpus to invest

- Looking to create alternate source of regular income post retirement

- Are retired or are few years away from your retirement (eg: 1 - 15 years)

Note: These are generic features and they may vary depending on the product selected. Please read the product brochure carefully of the selected product

Concerned about your post retirement life? Start now with HDFC Life pension plans and build your retirement corpus to enjoy a worry-free retirement

You should go for these, if you:

- Are Looking to accumulate and create a lumpsum retirement corpus

- Want to start planning for your retirement from an early age (Plans available from age 18 years onwards)

- Know the amount you want to invest every year

- Can start with investment as low as ₹ 2000 per month

Note: These are generic features and they may vary depending on the product selected. Please read the product brochure carefully of the selected product

HDFC Life QROPS

Have pension fund in the UK and looking to migrate it to India?

- Tax efficient transfer of pension funds from UK to India

- Enjoy steady income in India post retirement

- Avail attractive annuity rates and fund growth

A QROPS or Qualifying Recognised Overseas Pension Scheme helps Indians move their pension funds from the UK back to India. QROPS schemes must meet certain eligibility criteria set by HM Revenue and Customs. HDFC Life QROPS will facilitate the tax-efficient transfer of the pension amount accumulated in the UK to India.

QROPS PLANSRetirement/Pension Calculator

Use our calculator to find out how much you need to invest in your retirement plan for a smooth and hassle-free post-retirement life with HDFC Life's Retirement Planning and Pension Calculator.

How to Calculate the Return on a Pension Scheme?

Calculating the return on a pension scheme helps you understand how effectively your investment is growing over time. It involves the amount of contributions, interest rates accrued, and a general performance of the selected plan.

Here are some other elements of calculating the return on a pension scheme:

Understanding the Types of Returns

Pension schemes provide three broad categories of returns, which are given below:

Types of Returns in Retirement Plans |

Description |

Guaranteed Returns |

Give fixed income irrespective of the market’s performance. These are ideal for risk-averse investors seeking stability and predictable payouts. |

Market-linked Returns |

Fluctuate with the market movement. They offer higher growth potential but come with investment risk based on market trends. |

Bonus or Additional Returns |

Usually provided by insurers upon performance or surplus. These returns act as extra earnings and can enhance the overall value of your pension corpus. |

These categories help investors select a scheme that suits their risk tolerance and ultimate retirement aspiration.

Using a Retirement Calculator

A pension calculator is a basic online tool that calculates your retirement corpus based on crucial inputs like monthly contribution, rate of return, and investment term. You provide these inputs, and the calculator estimates the maturity amount, helping you plan accordingly.

It is a fast, convenient way to see future returns and make a well-informed decision for a financially sound retirement.

The Impact of Contribution Amount and Duration

Increasing your monthly contribution or extending your investment duration can significantly increase your retirement savings.

For instance, investing ₹5,000 monthly for 20 years at 8% returns yields around ₹30 lakhs, but extending to 30 years grows it to over ₹75 lakhs. This compound effect shows how consistent, long-term investments dramatically enhance your pension corpus over time.

## The values shown are for illustrative purpose only

Considering the Rate of Return

The return on investment has a significant impact on your pension corpus since higher returns cause higher growth due to compound interest. For instance, investing ₹10,000 per month for 20 years at 6% will give you around ₹46 lakhs, whereas at 10% it reaches almost ₹76 lakhs.

Market-linked plans involve approximation of reasonable returns based on historical patterns and risk considerations. Therefore, recognising this correlation helps in formulating realistic goals and selecting an optimal investment strategy for retirement planning.

Accounting for Inflation

Inflation decreases your retirement corpus value in the future, so it is crucial to target returns that exceed inflation. For example, if your scheme has an annual return of 7% but inflation is 5% per annum; your actual return is merely 2%.

In 25 years, this can significantly decrease your corpus value. Hence, choosing pension schemes that provide returns higher than inflation ensures your retirement income retains its worth and meets your future lifestyle demands.

Tax Implications on Pension Returns

Deduction under Section 80C –

Investment in notified Pension scheme of UTI or mutual funds provide tax relief under Section 80C of Income Tax Act,1961 during the accumulation stage up to ₹1.5 lakh

Deduction under Section 80CCC –

Section 80CCC Contribution to pension fund of insurance company also provide the deduction maximum upto Rs 1,50,000.

Deduction under Section 80CCD(1) –

Section 80CCD(1) Contribution to pension Scheme of central government / National pension scheme shall also provide the deduction to salaried employee or other individual subjected to the limit prescribed and an additional deduction of Rs. 50,000 is available under Section 80CCD(1B) for Contributions allowed other than contribution covered under Section 80CCD(1) i.e taxpayer can get opportunity to claim total tax benefit up to Rs. 2 lakhs.

Deduction with respect to Commutation of pension under Section 10(10A) –

Any payment received in commutation of pension as a lump sum on vesting (maturity) is exempt under section 10(10A)(iii) of the Income-tax Act, 1961, subject to fulfillment of various conditions under the current income-tax law.

Regular annuity received under the annuity plan will be taxable in the hands of the recipient.

Reviewing Additional Charges and Fees

Pension plans carry fees like policy management charges, fund management charges, and surrender charges, which lower overall returns. For instance, a 1.5% yearly fund management charge may not seem excessive but has a significant effect on long-term growth.

Always compare plans for low-cost structures and openness. Reviewing these charges before investing helps you get higher returns and value from your retirement savings in the future.

How to Calculate Future Value of Your Pension Plan

Estimating the future value of your pension plan helps you understand how much you’ll have at retirement. While formulas exist for calculating this, they can be complex. A more practical approach is to use online retirement calculators that handle the math for you.

These calculators factor in your regular contributions, investment returns, and number of years to retirement, delivering a quick estimate of your retirement corpus.

Moreover, inflation reduces the value of money over time.

To understand the impact of inflation, let us go through an example below:

If you invest ₹1, 00,000 today, you would need around ₹3, 20,710 in 20 years to have the same purchasing power, assuming 6% annual inflation. This shows why it's important to save and invest consistently for retirement.

## The values shown are for illustrative purpose only

Example of Pension Scheme Calculation

Suppose you plan to contribute ₹80,000 annually to your pension plan for 25 years, and expect an 8% average annual return. Using an online calculator, your estimated retirement corpus could be around ₹58 to ₹60 lakhs.

## The values shown are for illustrative purpose only

This illustrates how regular contributions and compounding can help you build a strong financial foundation for retirement, without needing to manually calculate it all.

For accurate planning, use the HDFC retirement calculators. They not only save time but also reduce errors, helping you stay on track toward your retirement goals.

Factors Affecting Pension Returns Over Time

Several elements drive pension returns, including market volatility, changes in interest rates, inflation, and the risk profile of selected investment schemes. Market-linked returns can be lowered during economic recessions, while higher interest rates could favor fixed income plans.

Better-diversified and regularly checked portfolios are likely to be more stable. As returns are not certain, periodic review of your pension scheme is useful in terms of re-adjusting strategies and alignment with long-term retirement objectives in a constantly dynamic financial scenario.

What are the factors to consider while buying a pension plan in India?

Buying a pension plan is an important financial decision that requires careful consideration of several factors. Here are the key factors to consider while choosing the most suitable pension plan:

Your retirement needs and wants

When do you plan to retire? – The answer to this question will determine your accumulation period (how long you have to invest) and payout period (how long will you receive a pension).

What is your desired lifestyle in retirement? – This is a very personal aspect of retirement planning and depends on your goals (hobbies you want to pursue) and your way of life (living in a metro vs. a tier 2 city) in retirement. For example, as per Numbeo.com’s cost of living data Mumbai is 13.7% more expensive than Bangalore (excluding rent) xvi.

What are your current and future expenses? – Factors like inflation, healthcare costs, anticipated living expenses will help you answer this question. You can use a pension calculator to get betters estimates.

Will you have dependents? – Assessing your financial dependents (spouse, children, parents others) will help you understand who you need to cover in retirement.

Type of Pension plan

In India you will find various types of pension plans with distinct features and benefits:

National Pension System (NPS) – It is a government backed, voluntary, market-linked retirement scheme for all Indians between the ages of 18-70 years. You get the flexibility of investment options (equity, debt or government securities) and attractive tax benefits.

Employee Provident Fund (EPF) – It is a mandatory retirement savings scheme for salaried individuals. Both you and your employer contribute towards your EPF.

Annuity Plans (from life insurance providers) – These are offered by life insurance companies where you need to invest in form of a lump sum or pay regular premiums. After the completion of the term of the policy you get a guaranteed income as your pension.

Investment options and your risk appetite

Asset allocation – It’s important for you to understand how the pension plan invests your money into different asset classes like equity, debt and government securities

Risk appetite – Your ability to take risk and your investment horizon should help you in selecting a pension plan. For example younger individuals can have a higher exposure in riskier assets such as equity because they will have enough time to recover from market downturns.

Returns offered – Some plans offer guaranteed returns like (EPF, PPF, guaranteed pension plans and others) while others offer market linked returns such as NPS. You need to evaluate the returns offered by a pension plan vs. the risks associated with it.

Inflation adjustment – Inflation as you know negatively impacts purchasing power over the long-term. Thus it’s important to choose a pension plan or investment strategy that has the potential to give inflation beating returns.

Tax benefits

Investments - Contributions into pension plans in India are largely exempted from taxes under the various sections of the Income Tax Act, 1961. For example, premiums paid for HDFC Life Click 2 Retire can be claimed for tax deductions under section 80C within the overall limit of Rs.1.5 lakh.

Interest earned - Check if the interests earned in the pension plan are exempted from taxes.

Payout or withdrawals – Understand the tax implications of lump sum withdrawals and annuity payments. For instance in NPS, 60% of the lump sum withdrawal is tax-free but the annuity income is taxed as per your tax slab. You can use a lumpsum calculator to determine the future value of your lump sum withdrawal and plan better. On the other hand withdrawals from EPF and PPF are completely exempted from tax.

Flexibility and liquidity options

Premium paying options – Check of the available premium payment options (monthly, annually or lump sum) or is there an option to increase or decrease the premium later.

Partial withdrawal options – Check whether you have the option to withdraw your funds partially during the accumulation for emergencies like medical expenses, child education and others. For example NPS allows limited partial withdrawal under specific situations.

Vesting age – This is the age at which you will start receiving the pension payments. You need to make sure that the vesting age is in line with your retirement age.

Portability – Check if your pension plan offers the flexibility to transfer your funds to another fund manager or scheme

Charges and fees

Do check for associated charges & fees in pension plans. Here are few common charges of pension plans:

Administrative charges :

To maintain your pension account

Fund Management Charges (FMC) :

To manage your investments

Premium allocation charges :

These are one-time fees deducted from your premium before it is invested. There are no premium allocation charges in HDFC Life Click 2 Retire

Mortality Charges :

Present in life insurance linked pension plans to provide the life cover

Surrender Charges :

Deducted if you withdraw before the maturity of the pension plan

Transaction Charges :

Deducted during transactions such as contribution or withdrawal

Rate of annuity

In the case of annuity plans, the rate of annuity determines your pension amount. Compare annuity rates across providers.

Life Insurer’s reputation and solvency ratio

You should opt for a life insurance provider that is reputed and has been in business for long enough. You can gauge the reputation of the provider to a certain extent by its Asset Under Management (AUM) and Solvency ratio. For example, HDFC Life’s AUM is ~Rs.3 trillion xvii and solvency ratio is 194% xviii (regulator requires solvency ratio to be at least 150%).

Death benefit and nomination

Check if the pension plan provides death benefit to your nominee in case of your death. Life insurance linked pension plans provide death benefit in case of the policyholder’s demise during the accumulation phase.

Online tools and calculators

There are several online tools such as the retirement and pension calculators to help you calculate your retirement corpus as per a particular pension plan.

Carefully consider all the above mentioned factors to choose a suitable pension plan that meets your retirement needs. It is also advisable to consult a financial advisor to get personalised recommendations.

Retirement Plans is incomplete without these riders**.

They help you deal with those additional risks life brings.

HDFC Life Income Benefit on Accidental Disability Rider

UIN: 101B013V03

Get additional income benefits over and above your Sum Assured in the event of total permanent disability due to an accident.

HDFC Life Critical Illness Plus Rider

UIN: 101B014V02

We pay a lump sum amount equal to Rider Sum Assured upfront if diagnosed with of any of the specified critical illnesses.

HDFC Life Protect Plus Rider

UIN: 101B016V01

Get protected with a proportion of Rider Sum Assured in case of accidental death or partial/total disability due to accident or diagnosed with Cancer

How Much Do I Need to Retire?

Estimating the amount you will need for retirement is the most crucial and personalised aspect of retirement planning. There is no fixed number, as it depends on your age, desired life style, financial goals and several other financial factors. In addition to planning for retirement, it’s also important to consider other financial protections, like term insurance plan, to ensure your family’s security in case of any unforeseen events.

Here are some key considerations to determine your retirement corpus:

Current age and retirement age

Your current and retirement age will determine the number of years you have to accumulate your retirement corpus through compounding. The earlier you start investing the lesser you would have to invest to achieve your desired retirement corpus.

...Read More

Estimate Daily Living Expenses

Determine how much you now spend each day on things like food, utilities, transportation, and medical care. After that, forecast these costs for the future while accounting for inflation. Building a realistic retirement corpus with accurate estimation enables you to support daily expenses without experiencing financial hardship once you stop earning.

...Read More

Life Events and Major Milestones

Major expenses do not stop when you retire. You might still have to pay for your kids' schooling, weddings, or other important occasions. You may make sure you are financially ready for these one-time but significant expenses by factoring these fees into your retirement plan.

...Read More

Post-Retirement Lifestyle and residence

Your personal objectives, such as taking up hobbies, travelling, or launching a small business, should be included in your retirement budget. These pursuits bring happiness, but they also cost money. Making plans for these guarantees that your retirement will be satisfying and fit your desired lifestyle. Your city of residence will also have an impact as the cost of living in metros & tier 1 cities can be really high.

...Read More

Emergency and Healthcare Expenses

As people age, unexpected crises and growing medical expenses are unavoidable. Your retirement funds are protected from abrupt exhaustion by a specific financial cushion for medical and emergency costs, which enables you to handle emergencies without jeopardising your daily financial stability.

...Read More

The Impact of Inflation Over Time

The value of money gradually declines as inflation raises living expenses. For instance, at 5% inflation, things that you can buy for Rs. 6 lakh now might cost you approximately Rs.14.38 lakh in 20 years. Your savings should realistically cover future expenses if you adjust your retirement corpus for inflation.

...Read More

Existing savings and additional Income Sources in Retirement

Savings are not the only source of retirement income. Your income can be supplemented by dividends, pensions, rental income, or part-time employment. These sources of income help you have a more pleasant and secure retirement by easing the strain on your retirement corpus.

...Read More

Expected rate of return

The expected rate of return will determine how much you will be able to grow the retirement funds you will be able to accumulate and by what time. The rate of return will primarily depend on the retirement plan you choose.

Taking all the above mentioned factors into consideration you can easily get the answer to the question of ‘how much do I need to retire?’ by using the retirement calculator.

...Read More

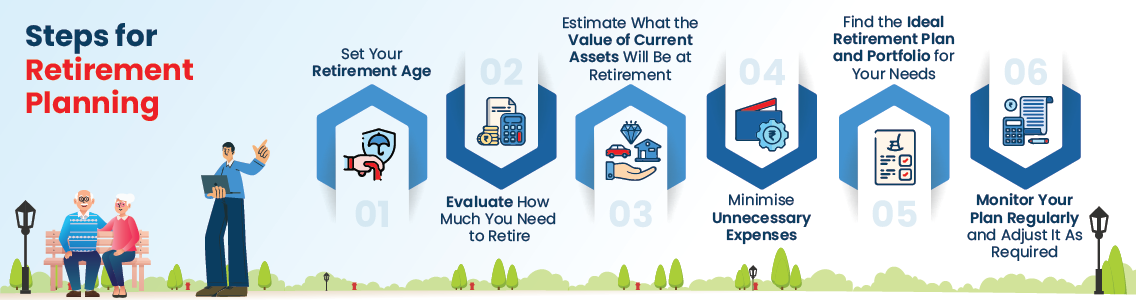

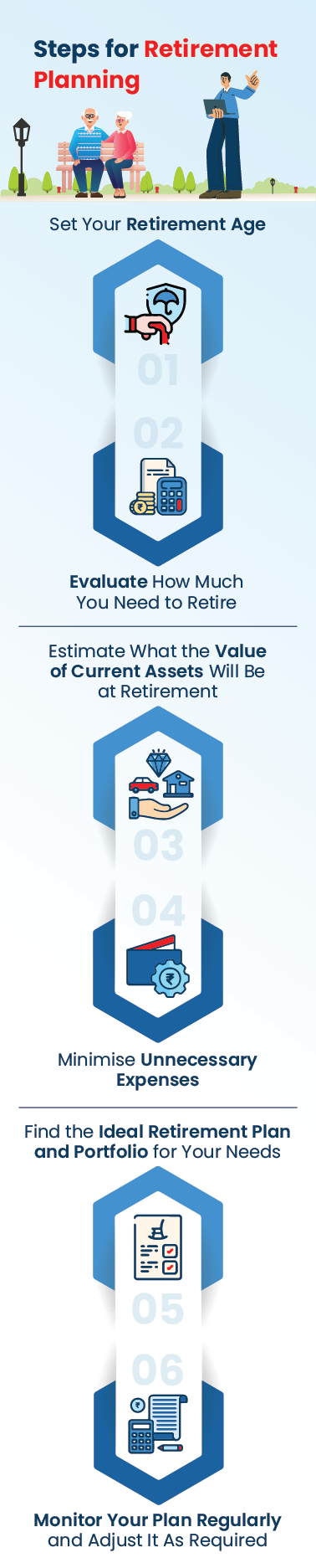

What are the Steps to Buy a Retirement Plan?

Following are the steps to consider if you want to buy a retirement plan for a better future:

-

![Set Your Retirement Goals Set Your Retirement Goals]()

Step 1

Set Your Retirement Goals

Start by identifying your retirement age, lifestyle expectations, and estimated monthly expenses. Consider future costs like healthcare, inflation, and travel. Clear goals help determine how much income you will need post-retirement.

-

![Assess Your Current Financial Position Assess Your Current Financial Position]()

Step 2

Assess Your Current Financial Position

Review your savings, fixed deposits, existing investments, and insurance. Compare your current financial status with your retirement goals to see how prepared you are and identify any shortfall.

-

![Identify all Income Sources Identify all Income Sources]()

Step 3

Identify all Income Sources

Include all possible retirement income, like pension schemes, annuities, real estate, and part-time work. Knowing your income mix helps ensure a reliable and fixed income during retirement.

-

![Fill the Financial Gaps Fill the Financial Gaps]()

Step 4

Fill the Financial Gaps

If your expected income falls short, consider increasing investments in retirement plans or opting for catch-up contributions. Adjust your asset allocation to beat inflation.

-

Step 5

Compare and Choose the Right Retirement Plan

Explore options from trusted insurers like HDFC Life. Compare plan features, vesting age, annuity options, and premium payment terms. Choose a plan that offers guaranteed returns and suits your risk appetite.

3 Reasons You Need To Start Your Retirement Planning Today

By your mid-thirties, chances are that your standard of living has improved significantly since your twenties, when you first joined the workforce. But have you considered what will happen when you are no longer able to work for a living? Retirement planning is not something to worry about later; it’s something you need to act on today. Starting early on building your retirement nest egg can make a world of difference to the security of your financial future.

Conducting a pension plan comparison at this stage is also crucial, as it helps you evaluate different options and choose the best plan for long-term financial security. Here’s why you should start planning for your retirement today.

More Savings, More Earnings

We all know the burden of taxes can be a hard one to bear, especially when you have a family to provide for. With the weight of these financial burdens, it can be easy to neglect yourself and your future financial security. You tell yourself that you’ll start saving for retirement once you get that promotion, once you turn 40 or once your kids go off to college.

However, the sooner you begin the better. In fact, investing money in your retirement plan can even help you save on taxes. By investing in retirement schemes such as the Public Provident Fund (PPF) and New Pension Scheme (NPS), you can avail up to Rs.1.5 lakhs in tax deductions under Section 80C.

What’s more, the power of compounding in retirement plan has a lot to offer you. Say you begin investing Rs.300 per month at the age of 25. Assuming an interest rate of 8%, you’d have over Rs.1 million by the time you are 65. Now if you invested the same amount starting at the age of 35, you’d have only Rs.440,000 at 65. In this case, starting a decade earlier would more than double your final amount. Additionally, if you're nearing retirement age, the Senior Citizen Saving Scheme could be an excellent option to consider for stable income.

Maintaining Your Independence

When you’ve spent your life supporting and providing for your children, it’s likely that they will want to help you out financially in your old age. However, being too dependent on them could mean them delaying their own financial goals as young adults. Wouldn’t it be better instead for you to have your own source of income? The earlier you start on your retirement savings, the bigger corpus you’ll have to fall back on. Perhaps you will even be able to help your children as they get settled!

And should something happen to you, a retirement plan or a pension plan will help ensure that your spouse and children are looked after in your absence.

Reaping Rewards

Sometimes it seems that the harder you work, the more inflation gets ahead of you. But what do you do about it? You save - not only for short-term goals and emergencies, but for your retirement as well. Even if it is only a small sum that you can manage to stash away at the end of the month, it’s better than nothing, and the small sum will grow eventually.

So don’t hesitate to start investing. Start small and let compounding do its job, so you don’t have to live small later in life. It’s possible to maintain your current standard of living after you retire or even go on that dream vacation. All it takes is the right approach, which may include investing in a Money Back Policy to secure your financial future.

Now that you’ve seen how early retirement planning can help you continue to live life on your own terms even after you’ve stopped earning, your next step is to start investing in a retirement plan. With the abundance of options available in the market, it can be difficult to zero in on the retirement plan for you. At HDFC Life, we provide retirement plans to help you meet the high cost of living and rising inflation. Choose from our range of pension plan options to find the one that best suits your needs.

Eligibility Criteria for Retirement Plans

To purchase a retirement plan, you need to fulfil the following eligibility criteria:

Minimum and Maximum Entry Age

Retirement plans typically have a minimum entry age of 18 years, ensuring individuals can start early. The maximum entry age varies by plan but usually ranges from 65 to 75 years. This wide age window allows both early planners and late starters to invest in a retirement solution that suits their financial timeline.

...Read More

Annual Premium Amount

The annual premium amount is flexible and depends on the chosen retirement plan, your age, and the desired retirement corpus. Most plans allow you to start with an annual premium as low as Rs. 10,000. Higher premiums can lead to larger retirement benefits, helping you accumulate a substantial fund for your post-retirement years.

...Read More

Minimum and Maximum Vesting Age

The vesting age is when the policyholder starts receiving pension benefits. Most retirement plans offer a minimum vesting age of 45 or 50 years, with a maximum of up to 80 years. This allows policyholders to tailor their retirement benefits based on personal career timelines and post-retirement income expectations.

...Read More

Premium Payment Term

The premium payment term can range from a single premium payment to regular payments over a specific number of years, such as 5, 10, or 20 years. This flexibility allows policyholders to choose a payment schedule that best matches their financial capabilities while ensuring uninterrupted policy coverage until retirement.

...Read More

Policy Term

The policy term is the total duration of the retirement plan and generally starts from 10 years and extends until the chosen vesting age. A longer policy term ensures disciplined long-term savings and allows your investment to grow over time, helping you accumulate a sufficient corpus for a financially secure retirement.

...Read More

Documents Required to Buy a Pension Plan in India

Individuals who want to purchase a retirement plan must be at least 18. Many companies will not allow individuals over 65 or 75 to buy retirement plans.

Documents to Be Kept Handy

Sr. No |

Documents |

Identity Proofs |

Address Proofs |

1 |

Passport |

Y |

Y |

2 |

Voter’s Identity Card issued by Election Commission of India |

Y |

Y |

3 |

Permanent Driving License |

Y |

Y |

4 |

Aadhaar Card |

Y |

Y |

5 |

Central KYC Identifier (can be accepted, if the downloaded documents are from the list of Officially Valid Documents (OVD) reflecting across Sr. No. 1 to 4 and there is no change in the address basis the document downloaded from Centralized KYC Registry (CKYCR) database as mentioned on the proposal form) |

Y |

Y |

FAQ's on Retirement Plans

We'll tell you everything you need to know about Retirement Plans.

What is a "retirement corpus," and how is it different from a pension?

Retirement corpus refers to the total lump sum you accumulate through savings, PF, investments, and NPS before retiring. On the contrary, a pension is the periodic retirement income drawn from this corpus or an annuity plan. Simply put, a corpus is the wealth you build; a retirement is how you receive it.

Retirement corpus offers flexibility, while pensions provide steady retirement income streams through employer or insurance-based annuity products. Both elements work together to ensure post-retirement financial security and stability.

What are the essential components of a well-rounded retirement plan?

A well-rounded retirement plan incorporates multiple key elements to ensure financial security in later years. Essential retirement plan components include a robust retirement corpus built through long-term savings and investments, as well as a pension or annuity to provide a steady income stream.

Adequate insurance (health cover and life cover) protects your savings, while an emergency fund ensures liquidity for unexpected expenses. Effective tax# planning optimises returns through instruments like Section 80C of the Income Tax Act, 1961 and NPS, and estate planning with wills or nominee’s guarantees smooth wealth transfer.

When is the best time to start planning and saving for retirement?

The best time for retirement planning is as early as possible, ideally in your 20s or 30s. Starting early allows you to take advantage of compounding, where even small investments grow significantly over time. Early starters can adopt higher-risk, equity-heavy strategies, while late starters need larger contributions to catch up.

Consistently start saving early for retirement savings, as long-term planning provides flexibility, financial security, and the potential for substantial growth, making your retirement years more comfortable.

When should I start planning for retirement?

Retirement planning really depends on what stage of life you are in. When you want to start really depends on you, your needs at 30 versus at 50 will be very different, so plan wisely.

If you are 20-30 years away from retirement then you need to be focused on accumulating retirement assets. At this stage try to get through the crunch years in decent overall financial shape (without credit, debts, etc.).

If you are 10-15 years away from retirement then it’s crunch time, and fine-tuning your retirement plan. Look at your income options, your retirement assets and align your retirement goals to them.

If you are just about to retire then it’s all about adjustments to minimize tax, maximize your income, and manage your assets. It’s about making your assets last as long as you can.

The earlier the retirement planning the better but the closer you get to your retirement, you will have to pay close attention to details.

What is the importance of insurance in retirement planning?

Many of us view life insurance as a way to protect families with death benefits. It is not just a savings or investment vehicle, but if needed, it can provide flexibility and access to a policy’s cash value, making it a valuable addition if properly utilized in a comprehensive retirement income plan.

Having an appropriate type with the correct amount of life insurance in your retirement will accomplish multiple things. It can help protect your income, provide tax-free cash flow, manage taxes, help your loved ones recover from any financial risks, and also improve the total returns in your portfolio.

In short, life insurance can provide more than just protection as it has the potential to provide protection and benefits throughout your retirement years.

Can I change the nominee of the retirement policy?

Yes, you can change the nominee on your policy. You can complete the process online by signing into your account and managing your policy online. Click the My Policy Tab and then select the Change in Nominee/Beneficiary Name option. Fill in the requisite details and submit your application to change the policy nominee.

What is the vesting date?

When talking about pension plans, the vesting date is the maturity date. So, it is the date when the policyholder starts receiving the benefits or the pension or when the pension corpus is invested into an annuity.

How can I Pay the Pension Plan Premiums?

You can pay your retirement plan premiums online via:

- Netbanking

- Credit card/ Debit card

- Debit Card with PIN

- SI on card

Whom should I contact for queries?

In case of any queries related to plan or form filling pls call our toll free number 1800 266 9777 or contact us at Buyonline@HDFCLife.in

For submitting documents or any other query after premium payment, you can write us at onlinequery@hdfclife.in or call us on toll free number 1800 266 0315.

Post policy Issuance you can reach out our customer service desk on 022-68446530 (Call charges apply) or write to us at SERVICE@HDFCLife.com

How do I calculate the retirement corpus?

You can use a mathematical formula to calculate your retirement corpus. This formula, known as the present value formula, is:

Present Value = Future Value · (1+r)n

Here, r is the rate of returns and n is the number of years.

What are the tax benefits on pension plans in India?

You can claim tax deductions on contributions you make to your pension plan up to INR 1,50,000 per year. The deduction terms are outlined under Section 80CCC of the Income Tax Act, 19615. For those considering a pension plan for NRI, certain plans in India also offer additional tax benefits under Section 80CCD5.

What are participating and non-participating pension plans?

Participating pension plans, also known as par policies, allow the policyholder to share the insurance company’s profits. So, whenever the company earns profits, the policyholder will earn a portion of these profits in addition to the pension plan’s guaranteed benefits. The benefits are known as bonuses, incentives or dividends.

In non-participating pension schemes, individuals do not earn additional incentives. They only get the guaranteed pension on the plan’s maturity.

I already have a provident fund account. Do I need a pension plan?

When it comes to planning for the future, you can never be too careful. While a provident fund account also allows you to save for the future, the kind of withdrawals you can make are limited. On the maturity of a provident fund, you can only withdraw a small portion of the funds. You must use the rest to purchase annuity.

With a pension plan, you can build up a corpus for the future and use it any way you wish since there is no cap on the amount you can withdraw on maturity.

Can I have multiple pension plans?

Yes, you can choose to invest in multiple pension plans. However, there is a limit on the maximum amount you can contribute across all policies, especially if you’d like to enjoy tax benefits5.

Does the pension plan in India end after the policyholder’s death?

No, most annuity plans come with a life insurance component. So if the policyholder passes away, the nominee will receive the benefits of the policy. They can choose to withdraw the entire amount or use a part of the amount to purchase an immediate annuity.

Is it better to have a retirement plan or a savings plan for retirement?

A retirement plan is specifically structured to provide a steady income after retirement, ensuring long-term financial security with features like annuity and tax benefits. While a savings plan offers more flexibility, it may lack guaranteed income. For retirement-specific goals, a retirement plan is often the more reliable and purpose-driven choice.

What is the best age for retirement?

The best age for retirement varies depending on personal goals, health, and financial readiness. In India, many people target retirement between 58 and 65 years. However, planning early in life, ideally in your 30s or 40s, ensures you build a strong retirement corpus and have the flexibility to retire when you choose.

Can I cancel my retirement plan and get the money?

Yes, you can surrender your retirement plan and receive its surrender value. The amount is based on factors like the length of time you were in the plan and the total premiums you have paid. This action will terminate the policy and cease all the policy benefits.

Should I save for my retirement or my child’s education first?

Prioritise your retirement first, loans are available for education, but not for retirement. Start investing early for retirement to benefit from compounding, and then align your child’s education fund with realistic timelines. Use separate, goal-based investments like SIPs in mutual funds or insurance-linked plans to balance both. A sound retirement plan ensures you don’t burden your child financially later in life.

What are the Different Types of Annuity Payout Options Available?

There are four types of annuities:

Lifetime Annuity: Provides a lifetime fixed payout; these stop at the annuitant’s death.

Joint-life Annuity: Offers financial security to you and your partner for the rest of your lives. The payouts can be chosen on a monthly or an annual basis.

Return of Purchase Price: Combines the lifetime income stream with a principal safety net. So, in case of the annuitant’s death, the principal goes to the nominee.

Increasing Annuity: Enables the annuitant to fight inflation through a consistent payout increase over time. So, you can maintain the purchasing power of your investment.

Can I Withdraw My Retirement Corpus Partially Before Maturity?

Yes, you can withdraw your retirement corpus partially before maturity; however, it is only permitted under specific conditions. For example, under the National Pension Scheme (NPS), if you are facing a medical emergency, you can withdraw 25% of your NPS contributions.

Furthermore, if you want to withdraw prematurely from ULIP-based retirement plans, you need to complete the 5-year lock-in period. Although withdrawals after the lock-in period are tax-free, you need to ensure that the withdrawal amount does not exceed the threshold of 10% of the sum assured, as mentioned in the Income Tax Act Section 10 (10D).

What Happens to the Pension Plan if the Policyholder Dies During the Accumulation Phase?

Since the primary idea behind most pension plans is to ensure not only you but also your family’s financial security, if a policyholder dies during the accumulation phase, the nominees receive the accumulated fund as a lump sum. In policy terms, this is referred to as the death benefit.

Need Help to Buy a Right Plan?

Our expert will assist you in buying a right plan for you online.

Reach us between 9 AM - 10 PM IST.

For existing policy related assistance, click here.

A certified expert of HDFC Life will help you.

99.68% Claim Settlement Ratio

For FY 2024-2025

~5 Cr. Number Of Lives Insured

For FY 2024-2025

Please enter valid name

Please enter valid mobile number

This field is required!

This field is required!

This field is required!

Please valid the captcha

Disclaimer: By submitting your contact details, you agree to HDFC Life's Privacy Policy and authorize ...Read More

99.68% Claim Settlement Ratio

For FY 2024-2025

~5 Cr. Number Of Lives Insured

For FY 2024-2025

Key Highlights

-

![key points key points]()

Financial independence once you retire.

-

![key points key points]()

Means to fulfil your retirement goals.

-

![key points key points]()

Life coverage, offering financial stability to your loved ones.

-

![key points key points]()

Tax savings.

-

![key points key points]()

Guaranteed returns in your golden years.

-

![key points key points]()

Low entry age of 18.

-

![key points key points]()

Limited premium-paying term.

-

![key points key points]()

Options to choose payment frequency.

Here's all you should know about Retirement Investment

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- term insurance

- savings plan

- ULIP

- Pension Plan

- health insurance plans

- child insurance plans

- group insurance plans

- income tax calculator

- bmi calculator

- compound interest calculator

- HRA Calculator

- get pension of 30000 per month

- get pension of 50000 per month

- one crore retirement plan

- monthly pension of ₹1 lakh

- Investment Calculator

- annuity plans

- retirement planning

- 10 year retirement plan

- 20 year retirement plan

- What is Term Insurance

- Capital Guarantee Solution Plans

- Annuity From NPS

- Retirement Calculator

- Pension Calculator

- What is Investment

- nps vs ppf

- short term investment plans

- safest investment options

- one time investment plans

- types of investments

- Best Investment Plans

- Money Back Policy

- NPS Calculator

- 1 crore term insurance

- life Insurance policy

- life Insurance

- Gratuity Calculator

- Zero Cost Term Insurance

- critical illness insurance

- Whole Life Insurance

- benefits of term insurance

- types of life insurance

- types of term insurance

- Endowment Policy

- Benefits of Life Insurance

- Term Insurance for NRI

- Term Insurance for Women

- Term Insurance for Self Employed

- child savings plan

- Benefits of Health Insurance

- Health Insurance for Senior Citizens

- Health Insurance for NRI

- Saving Schemes

- Ulip for NRI

- Life Insurance for NRI

- Investment Plans for NRI

- NRI Retirement Plans

- Savings Calculator

- Best Term Insurance Plan for 1 Crore

- features of term insurance

- personal accident insurance

- Annuity Calculator

- Insurance Advisor

- Types of Retirement Plan

i. https://economictimes.indiatimes.com/news/new-updates/retirement-isnt-just-about-money-zerodha-co-founder-nikhil-kamath-on-early-retirement-and-on-the-fire-trend/articleshow/114947402.cms?from=mdr

ii. https://www.financialexpress.com/business/healthcare/indias-healthcare-costs-to-rise-13-in-2025-beat-global-average-report/3800929/#:~:text=Healthcare%20costs%20in%20India%20are,year%20accordign%20to%20a%20report.

iii. https://www.macrotrends.net/global-metrics/countries/ind/india/life-expectancy

iv. https://www.axismaxlife.com/iris-india-retirement-study-index

v. https://www.pib.gov.in/PressReleasePage.aspx?PRID=2122148

vi. https://www.swiggy.com/corporate/wp-content/uploads/2024/10/20240924_RSC_Project-Tiger_Industry-Report_UDRHP_vf.1-1.pdf

vii. https://www.epfindia.gov.in/

viii. https://npstrust.org.in/sites/default/files/inline-images/22-Exit-FAQs-All-Citizen-Model.pdf

ix. https://npstrust.org.in/sites/default/files/inline-images/05-All-Citz-Mdl-Faq.pdf

x. https://npscra.nsdl.co.in/nsdl/scheme-details/APY_Brochure.pdf

xi. https://www.nsiindia.gov.in/(S(uknfpmrxfh3ghp55zhjeny55))/InternalPage.aspx?Id_Pk=55

xii. https://fundsindia.com/blog/wp-content/uploads/2025/05/202505-FundsIndia-Wealth-Conversations.pdf

xiii. https://www.outlookmoney.com/magazine/money/story/from-savings-to-security-how-indians-are-preparing-for-their-sunset-years-1660

xiv. https://www.outlookmoney.com/magazine/money/story/from-savings-to-security-how-indians-are-preparing-for-their-sunset-years-1660

xv. https://tradingeconomics.com/india/life-expectancy-at-birth-female-years-wb-data.html

xvi. https://www.numbeo.com/cost-of-living/in/Mumbai

xvii. https://www.hdfclife.com/content/dam/hdfclifeinsurancecompany/about-us/pdf/media-centre/press-release/2024/Jun-2024/HDFC-Life-Assets-Under-Management.pdf

xviii. https://www.hdfclife.com/content/dam/hdfclifeinsurancecompany/about-us/pdf/investor-relations/financial-information/Quarterly-financial-results/HDFC-Life-12M-FY2025-Press-Release.pdf

1. The word “Guaranteed” and “Guarantee” mean that annuity payout is fixed once the policy has been purchased.

3. Loyalty addition would be added to the fund starting from 10 policy anniversary for the other than ‘Single Premium’ policies paying annualized premium of ₹ 1,00,000 at least and for all the Single Premium paying policies.

5. As per Income Tax Act, 1961. Tax benefits are subject to changes in tax laws.

6. Lock in – Applicable if Variant 2 - With Guaranteed Income variant is chose

9. Allowed only after completion of 3 years from commencement of policy, upto 3 times during policy term, maximum upto 25% of the total premiums paid, subject to receipt of all due past premiums or if Waiver of Premium (WOP) benefit has been triggered

HDFC Life Guaranteed Pension Plan (UIN: 101N092V16) is a non-linked non-participating pension plan. Life Insurance Coverage is available in this product.

HDFC Life Click 2 Retire (UIN:101L108V05) A Unit Linked, Non-Participating Individual Pension Savings Plan. Life Insurance Coverage is available in this product.

HDFC Life Sanchay Aajeevan Guaranteed Advantage is a non-linked non-participating individual savings pension plan (UIN: 101N208V01). Life Insurance coverage is available in this product.

The Unit Linked Insurance products do not offer any liquidity during the first five years of the contract. The policyholders will not be able to surrender or withdraw the monies invested in Unit Linked Insurance Products completely or partially till the end of fifth year.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. HDFC Life Insurance Company Limited is only the name of the Insurance Company, the name of the company, name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns.

HDFC Life Smart Pension Plus UIN:101N173V12. A Non-Linked, Non-Participating Individual/Group Annuity Savings Plan.

HDFC Life Smart Pension Plan (UIN: 101L164V08) A Unit Linked, Non-Participating Individual Pension Plan. Life Insurance Coverage is available in this product.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions.

HDFC Life Insurance Company Limited is only the name of the Insurance Company, HDFC Life is only the name of the brand and HDFC Life Click 2 Retire (UIN: 101L108V05) is only the name of the unit linked life insurance contract. The name of the company, name of the brand and name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns. This Product brochure is indicative of the terms, warranties, conditions and exclusions contained in the insurance policy.

#Tax benefits & exemptions are subject to the conditions of the Income Tax Act, 1961 and its provisions.Tax Laws are subject to change from time to time.Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

*The returns shown (32.4% over 5 years) are based on the historical Compound Annual Growth Rate (CAGR) of the HDFC Life Top 300 Alpha 50 Pension Fund. Past performance is not indicative of future performance. The fund performance is not guaranteed, and the returns shown are market-linked. Please read the sales brochure carefully before concluding any purchase.

Unit Linked Life Insurance products are different from the traditional insurance products and are subject to the risk factors. The premium paid in Unit Linked Life Insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of fund and factors influencing the capital market and the insured is responsible for his/her decisions. HDFC Life Insurance Company Limited is only the name of the Insurance Company, HDFC Life is only the name of the brand and HDFC Life Smart Pension Plan (UIN: 101L164V08)is only the name of the unit linked life insurance contract. The name of the company, name of the brand and name of the contract does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges, from your Insurance agent or the Intermediary or policy document of the insurer. The various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns.

*^Life Annuity and Life Annuity with Return of Purchase Price is fully guaranteed annuity option. Annuity rate is fixed once the policy has been purchased and shall remain the same for the duration of the policy. Amount of guaranteed income will depend upon premiums paid subject to applicable terms and conditions. These 2 options are not linked to Nifty50 benchmark

^^In Option C, Variable Annuity with Return of Purchase Price, 60% of Purchase Price contributes towards guaranteed annuity and remaining is linked to Nifty 50 benchmark

ARN: PP/01/26/30210

RETIREMENT PLANS BUYING GUIDE

RETIREMENT PLANS BUYING GUIDE