In ULIP Plan, the investment risks in the investment portfolio is borne by the policyholder

HDFC Life C2I and Sanchay Fixed Maturity Plan 100% Capital Guarantee Combo plan

A capital guarantee solution combined plan designed to offer a dual benefit of guaranteed return1 of capital and high gains from market-linked funds.

UIN:101N142V08 | UIN : 101L178V01

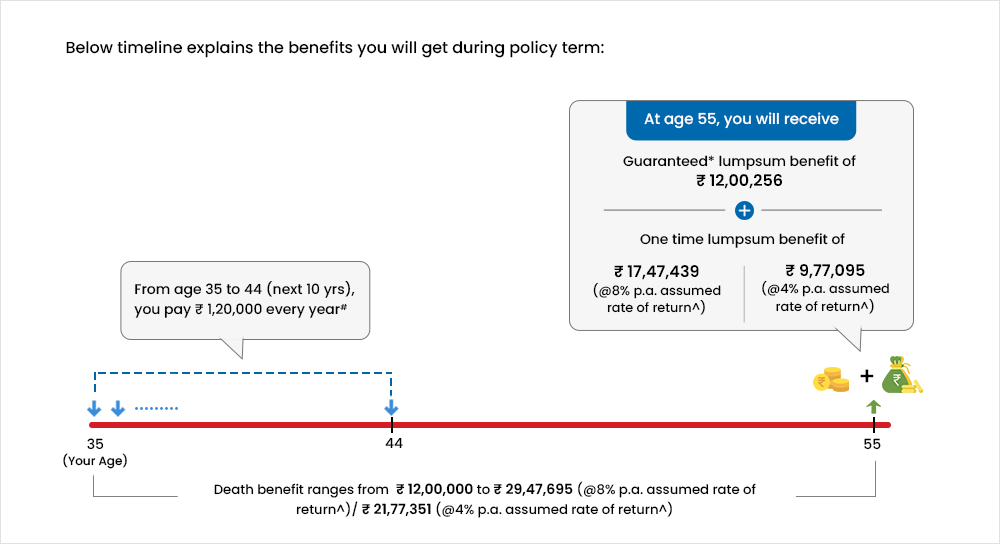

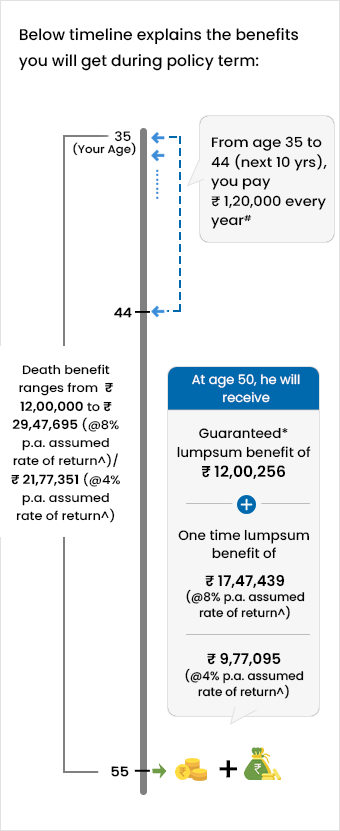

- Dual Benefit of guaranteed1 returns and market linked returns3

- Capital Guarantee in the form of guaranteed1 lumpsum amount on policy maturity

- Get market linked returns3 as lumpsum on policy maturity

- Flexibility to choose premium paying term and policy term as per your needs

- Get tax benefit as per prevailing tax laws2