What do you want to do?

Income Tax Refund - Everything you need to Know

Table of Content

3. Eligibility Criteria For An Income Tax Refund?

4. How To Claim Income Tax Refund?

5. Due Date To File Income Tax Refund?

6. Interest on Income Tax Refund

7. How To Check Income Tax Refund Status Online?

8. How Tax Refunds Are Issued?

9. Which ITR Form is Used for Claiming an Income Tax Refund in India?

10. What are the Payment Methods for Income Tax Refunds?

11. Steps to Update Details with the Income Tax Department

12. How is Income Tax Refund Processed?

13. What is the Ideal Duration for Receiving an Income Tax Refund?

14. Conclusion

Once you start earning, you are educated about the importance of filing income tax returns. You would have come across the termincome tax refund several times. You must have wondered what is income tax refund and why it is mandatory to file income tax returns even if you are not in the tax bracket.

Well, this article helps you understand tax refund meaning and offers you in-depth knowledge about the intricacies of filing your income tax return to get a timely refund.

What is Income Tax Refund?

Before you get into the details of assessing your tax liability, it is important to understand what is income tax refund. Read on to find out.

The tax refund meaning is the reimbursement a taxpayer gets from the income tax department when he/she pays tax above the actual tax liability. This happens in the event of paying advance tax or if there are any TDS deductions for your income.

Only if you can comprehend income tax refund meaning will you understand the necessity to calculate the tax liability in advance and avoid paying excess tax. In case you have paid excess tax you will get the refund only after filing your income tax return (ITR). It is recommended to estimate your tax liability for the financial year and adjust any advance tax or TDS deductions to avoid paying excess tax. Instead, you can invest the funds for gains.

Income Tax Refund-Example?

What is income tax refund can be better explained with an example.

Raju has an annual income of Rs. 10.00 lakhs. He has made investments with tax benefits under 80C to the extent of Rs. 1.50 lakhs, is paying a medical insurance premium of Rs. 12000/- and has a House Rent Allowance (HRA) of Rs. 10000The tax liability under both old and new tax regimes are as per the calculations shown in the table:

Details |

Tax slab |

Old Tax Regime |

New Tax Regime |

Gross Income |

Rs.7.00,000 |

Rs. 7,00,000 |

|

HRA |

10,000 |

||

Deduction under Section 80C |

Rs. 1.50,000 |

Nil |

|

Deduction under Section D |

Rs. 12000 |

Nil |

|

Taxable income |

Rs. 5,28,000 |

Rs. 7,00,000 |

|

Tax calculation as per the old tax regime |

|||

Up to Rs. 2.5 lakhs |

0% |

Nil |

|

2.5 lakhs to 3 lakhs |

5% |

Rs. 2500 |

Nil |

Rs. 3 lakhs to Rs. 5 lakhs |

5% |

Rs. 10000 |

|

Rs. 5 lakhs to Rs. 10 lakhs |

20% |

Rs. 5600 |

|

Tax calculation as per the new tax regime |

Rs. 18100 |

||

Up to Rs. 3.00 lakhs |

Nil |

Nil |

|

Rs. 3.00 lakhs to Rs. 5.00 lakhs |

5% |

Rs. 10000 |

|

Rs. 5.00 lakhs to Rs. 6.00 lakhs |

5% |

Rs. 5000 |

|

Rs.6.00 lakhs to Rs. 7.00 lakhs |

10% |

Rs. 10000 |

|

Tax payable |

Rs. 18100 |

Rs. 25000 |

|

Rebate under Section 87A |

Nil |

Rs. 25000 |

|

Cess at 4% |

Rs. 724 |

Nil |

|

Tax payable |

Rs. 18824 |

Nil |

If the tax paid amounts to more than the tax liability by way of TDS deduction or advance tax, the excess tax paid will be refunded. This is the tax refund meaning. For instance, TDS has been deducted from salary and on claiming all the deductions and rebates, if the tax liability amounts to lower than the tax paid, then the Income tax department will refund the excess tax paid.

Eligibility Criteria For An Income Tax Refund?

After your quest about what is income tax refund is has been clarified, it is also important to know the eligibility criteria for an income refund.

The advance tax paid as per your estimated assessment should be more than 100% of the actual tax liability. The income tax refund meaning becomes clear when you understand what advance tax is. Anyone whose tax liability is over Rs. 10000/- in a financial year has to pay advance tax.

The TDS rates applied by the bank on your fixed deposit resulted in excess TDS deductions.

In the absence of proof of tax-saving investments, the tax deducted by your employer exceeded the actual tax liability.

When you are a citizen of one country and earn income from another country, the double taxation rules apply. India has an agreement with a few countries for a Double Taxation Avoidance Agreement (DTAA). If you are an NRI working in a country with which India has the DTAA, you can claim a refund for income earned on assets in India like NRO deposits. The interest on NRO deposits attracts tax at the applicable income tax slab rates. If you are an assesse in the foreign country you reside in, you can claim a refund for the TDS deductions on your NRO deposits in India.

How To Claim Income Tax Refund?

If you are an assessee, many times you will be asked if you are eligible for an income tax refund. Then you will wonder what is income tax refund and how to go about it. Claiming the refund of tax paid more than your tax liability is the income tax refund meaning.

Filing your income tax return accurately before the due date is the best way to claim an income tax refund. Form 26AS will give you an idea of the advance tax payments for a financial year. The officer in the Income Tax Department should approve the tax calculations in the ITR. If the advance tax payments in Form 26AS are more than the tax liability, then the refund will be initiated.

You can also file Form 30 to review your income tax payments against your tax liability. The refund will be faster if you provide your bank details and opt for a direct transfer.

A provision to check your income tax refund status on your e-filing dashboard is also provided.

Due Date To File Income Tax Refund?

Taxpayers are curious about what is income tax refund and what is the claim process. But the most important aspect is the due date to file an income tax refund. Even after understanding the income tax refund meaning and the claim process, if there is a delay in filing the form for refund, you may have to forego the excess amount paid.

You will have to claim the income tax refund within 12 months after the end of the assessment year. For instance, for the AY 2024-25, you should claim the income tax refund before 31st March 2025.

Interest on Income Tax Refund

The Income Tax Department pays interest on the refund if the refund is 10% or more of the total tax paid. As per Section 244A of the Income Tax Act, 1961, the refund will attract a simple interest at 0.5% per month or part of the month on the tax refund due. This interest is calculated from the 1st of April of the applicable assessment year till the date of disbursing the refund. This happens only if the ITR returns are filed on or before the ITR filing due date.

In case the filing of income tax returns is delayed, the interest is calculated from the date of filing income tax return till the date of grant of refund.

How To Check Income Tax Refund Status Online?

With your curiosity about what is income tax refund addressed, you can check the ITR status online using either the income tax e-filing portal or the NSDL website by following the steps given below:

Steps to Check the Status of Income Tax Refund Online on the NSDL Website

1. Visit the NSDL website.

2. Enter your PAN and the assessment year.

3. Your income tax refund status will appear on the screen.

Steps to Check the Status of Income Tax Refund Online on the E-filing Portal

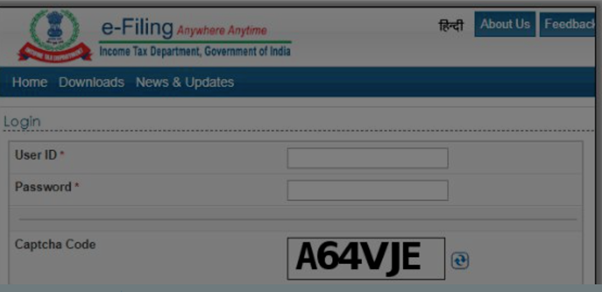

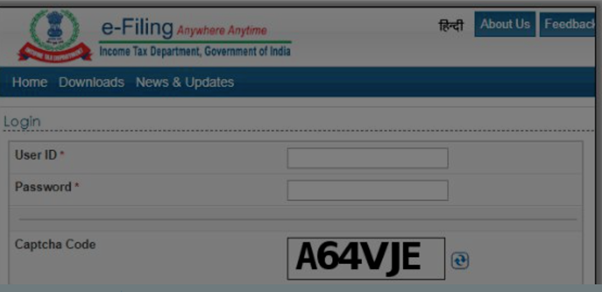

1. Access the e-filing portal of the Income Tax Department.

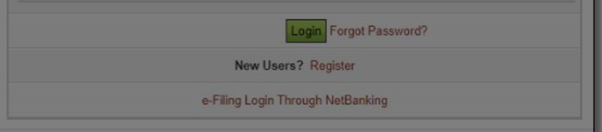

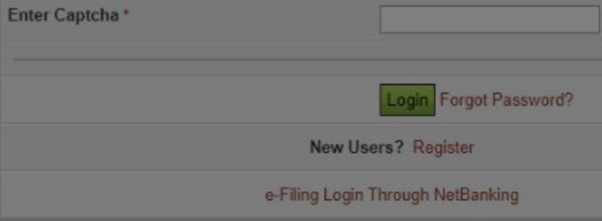

2. With your login credentials, access your account.

3. Choose the ‘View Returns/Forms’ option.

4. Go to the ‘My Accounts’ option and select ‘Income Tax Return’ from the dropdown menu.

5. Click on the acknowledgement that appears on the screen.

6. You will be directed to the page with the details of your ITR and the income tax refund status.

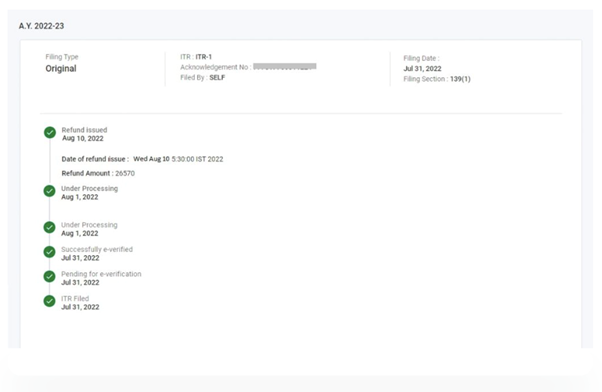

The income tax status will be seen as shown in the picture below:

How Tax Refunds Are Issued?

Besides knowing what is income tax refund you should also be informed about how the tax refunds are issued as well. Here are the steps involved in the refund process.

Filing your income tax return (ITR) is the first step.

The tax authorities verify the information provided in the ITR, like the gross income deductions that include HRA and eligible tax benefits under various subsections of Section 80. They then assess the tax liability and the eligible refund, if any.

The verification also includes ensuring compliance with tax regulations.

If you are eligible for a tax refund, the authorities will calculate the refund amount.

There is an approval process to ensure the accuracy and adherence to CBDT guidelines.

On approval, a refund order is generated with the name of the taxpayer, bank details, and the refund amount.

Electronic funds transfer (NEFT) is initiated to credit the amount to the taxpayer’s account.

Which ITR Form is Used for Claiming an Income Tax Refund in India?

Earlier, ITR Form 30 was necessary to file the income tax refund. With e-filing in vogue, you can claim the refund by filing the income tax return before the due date, i.e., 31st July of the financial year.

What are the Payment Methods for Income Tax Refunds?

If you have furnished your bank details in the ITR while filing the return, the tax refund will be directly credited to your account through electronic transfer (NEFT). Otherwise, the refund will be via a cheque sent by speed post to the contact address furnished in the ITR.

Steps to Update Details with the Income Tax Department

To update the details with the Income Tax Department, follow the steps given below:

1. Access the official website of the Income Tax Department.

2. Login to your account with login credentials.

3. Click on the dashboard that appears on the screen.

4. Modify your bank account and contact details.

5. The Central TIN database is automatically updated with the changes to your bank and contact details.

How is Income Tax Refund Processed?

The IT authorities at the Centralized Processing Centre (CPC), Bangalore, process the Income Tax (IT) refund. Once the taxpayer files the income tax returns, the refunds are processed. If the assessee is eligible for a tax refund, an IT refund order is generated by the IT authorities, and the order is sent to the IT refund banker to initiate an electronic transfer to the taxpayer’s account.

What is the Ideal Duration for Receiving an Income Tax Refund?

What is income tax refund is the primary information you need to understand the implication of filing your income tax returns even if you fall under the nil tax bracket. You should also know how long it takes to get the refund. Usually, if you file the IT returns before the due date, i.e., 31st July of a financial year, the refund amount will be credited to your account within 4 to 5 weeks after the processing.

Conclusion

One question that always crops up before filing the ITR is what is income tax refund? The seriousness of timely filing of ITR is understood when the tax refund meaning is analysed. File your ITR before the due date this financial year and avail of the eligible refund.

FAQs on Tax Refund

Who is eligible to pay for an Income Tax Refund?

When considering what is tax refund, eligibility is also to be considered. You are eligible for an IT refund if you have paid tax above your tax liability by way of advance tax or TDS deductions.

Is it compulsory to file an Income Tax Return to process the refund?

Only if you file an income tax return will the IT authorities be able to process a refund by verifying the information provided in the ITR.

What is the due date to claim a tax refund?

Alongside getting the clarification for the query, what is tax refund you need to know within what date to claim the refund. The tax refund should be claimed within 12 months after the end of the assessment year.

Who can I reach out to for questions regarding refunds?

You can call the CPC, Bangalore toll-free number 1800 1034455 for queries regarding income tax refunds.

Are there any required documents or proofs while filing my income tax returns?

Familiriasing yourself with what is tax refund includes, information about producing documents, i.e., certificates and receipts concerning tax-saving investments made while filing income tax returns.

Here's all you should know about life insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

#Tax benefits & exemptions are subject to conditions of the Income Tax Act, 1961 and its provisions.

#Tax Laws are subject to change from time to time.

#Customer is requested to seek tax advice from his Chartered Accountant or personal tax advisor with respect to his personal tax liabilities under the Income-tax law.

1. Provided all due premiums have been paid and the policy is in force.

15. Save 46,800 on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are a Regular Individual, Fall under 30% income tax slab having taxable income less than Rs. 50 lakh and Opt for Old tax regime.

ARN - INT/ED/02/24/8739