What do you want to do?

![]() Quick Links

Quick Links

- Annuity Customer Service New

- NRI Center New

- Quick Services

- Service Help Guide

- Document Advisor

- Forms & Download

- Demat

- Video Life Certificate

- New Business Related

- DIY: Initiate My PCVC

- Taxation

- Bonus

- Key Features Document

- Track service request

- Interactive Voice Response (IVR)

- Pay Premium

- Online Mandate Registration - Loans

- Online Loan Payment

- IRDAI TAT poster

Ayushman Bharat Health Account (ABHA) is a 14-digit number which uniquely identifies you as a participant in India’s digital healthcare ecosystem. As a policy holder with HDFC Life, we would encourage you to create your ABHA number by using either your Aadhaar or driving licence details by clicking here

Explore our collection of DIY Video Tutorials for quick, easy solutions to your most frequent policy needs. Get the help you need, anytime, anywhere!

Quick Guide to Updating Your Profile Details | Self Service Simplified Video Series

Easy Steps to Update Your Bank Details Online | Self Service Simplified Video Series

Quick Steps to Download Your Policy Statement | Self Service Simplified Video Series

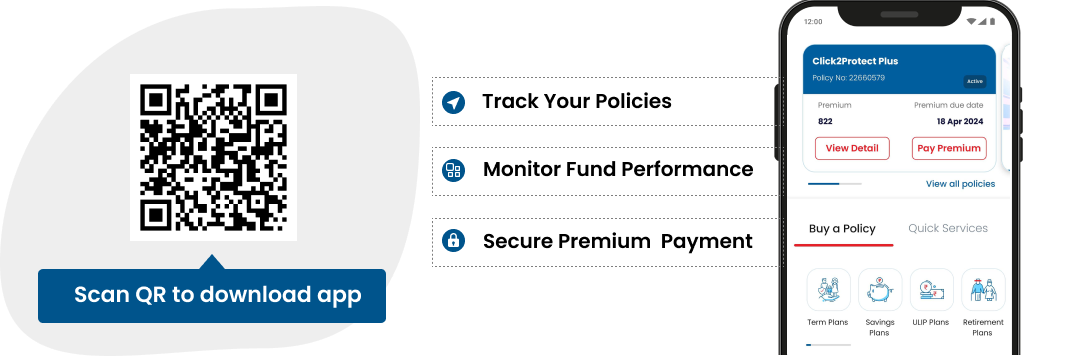

Step-by-Step Guide: Master the New HDFC Life Mobile App | Self Service Simplified Video Series

ARN: INT/DS/08/24/14059