What do you want to do?

Senior Citizens Health Insurance Plans

Table of Content

1. What is Senior Citizen Health Insurance?

2. Features of Health Insurance For Senior Citizens

3. Benefits of Health Insurance For Senior Citizens

4. Why is Health Insurance Necessary for Senior Citizens?

5. What Does a Health Insurance Plan for Senior Citizens Cover?

6. What does a health insurance plan for senior citizens not cover?

7. Important Factors When Purchasing Health Insurance for Senior Citizens

8. Documents Required for Senior Citizen Mediclaim Policy Claim

9. Claim Settlement Process for Medical Insurance for Senior Citizens

10. Tax Benefits of Health Insurance for Senior Citizens

11. Why is separate Health Insurance Necessary for Senior Citizens in India?

12. How Can I Purchase Health Insurance for Senior Citizens?

13. Common Misconceptions about Health Insurance for Senior Citizens in India

14. Latest Update on Senior Citizen Health Insurance Premium by IRDAI

15. Summary

What is Senior Citizen Health Insurance?

Senior Citizen Health Insurance is a plan that covers individuals aged 60 and above. It provides coverage for medical expenses like hospitalisation, pre/post-hospitalisation, annual checkups, and pre-existing conditions. It also offers the facility of cashless hospitalisation at network hospitals, enabling access to immediate treatment without financial burden. Some plans also include ambulance charges and domiciliary treatment.

Features of Health Insurance For Senior Citizens

Health insurance for senior citizens in India provides coverage for medical expenses, specialised treatments, and pre-existing health conditions. Other additional features of senior citizen health insurance plans are:

Reset Benefit

Some senior citizen health insurance plans permit you to reset the sum assured up to 100% (once in a policy year) if you have exhausted the entire amount during the policy term. Senior citizen Mediclaim policy with the reset benefit is ideal for the elderly with health issues that require frequent hospitalisation and treatment.

Ambulance Charges Coverage

In some medical emergencies availing of ambulance services becomes inevitable. In such cases, the Mediclaim for senior citizens covers the charges.

Cashless Hospitalisation

The best health insurance for senior citizens is the plan with the cashless hospitalisation feature. You can avail of treatment in network hospitals without incurring any expenses. The insurance company settles the hospital bills directly. Senior citizens can get quality treatment without worrying about finances.

Program for Managing Care

It is an additional feature in insurance for elderly, which includes online consultation, counselling, diet and nutrition advice. It also includes a health management program to enhance their quality of life and ensure they stay active and healthy.

AYUSH Treatment Coverage

AYUSH treatment coverage under health insurance forsenior citizens in India includes Ayurveda, Yoga and Naturopathy, Unani, Siddha and Homeopathy. These traditional treatment methods are government-regulated. This feature allows senior citizens to choose conventional treatment methods without financial constraints.

Free Annual Health Check-up

With the best health insurance for senior citizens, policyholders are entitled to free annual health check-ups. This enables the detection of health issues early for timely treatment. It helps manage health conditions and avoid complications.

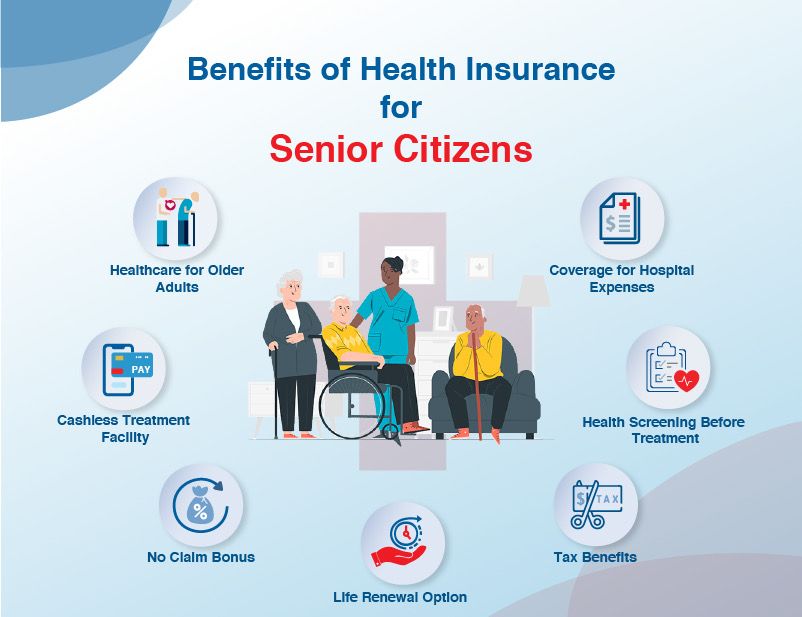

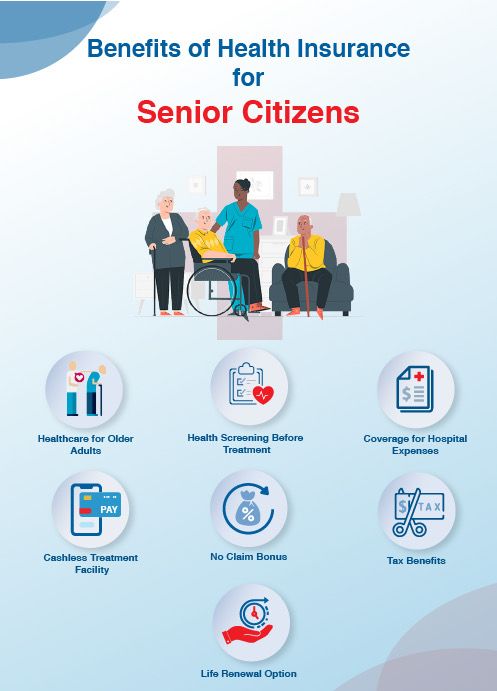

Benefits of Health Insurance For Senior Citizens

For timely medical treatments without financial strain, health protection for seniors is a must. The benefits of the senior citizen health insurance plan are discussed below:

Healthcare for Older Adults

Regular insurance plans generally do not provide coverage for individuals over 65 years. The elderly medical coverage plans help overcome this issue. It provides coverage for individuals aged 60 and above.

Health Screening Before Treatment

Senior citizens health insurance covers health screenings before treatment, including diagnostics, physical examinations, and imaging, and makes it affordable for them.

Coverage for Hospital Expenses

The Mediclaim for senior citizens covers inpatient expenses such as nursing care, surgery, doctor’s fees, prescriptions, and pre and post-hospitalisation costs.

Cashless Treatment Facility

Senior citizens with insurance coverage for aging population receive cashless treatment at network hospitals, with expenses approved and settled directly by the hospital.

No Claim Bonus

No claim bonus is the discount on renewal premiums for every claim-free year. Some elderly health coverage plans provide a 10 to 20% discount which makes a huge difference for senior citizens.

Lifetime Renewal Option

The lifetime renewal option in aging population insurance plans allows renewal of the policy every year without an upper age limit. This ensures lifelong medical coverage for them.

Tax Benefits

The premiums paid towards elderly health coverage plans are eligible for tax benefits# under Section 80D of the Income Tax Act 1961.

Why is Health Insurance Necessary for Senior Citizens?

Health insurance coverage for elderly is highly important to manage the financial strain associated with hospitalisation. The other reasons why insurance coverage is needed for individuals aged 60 and above are discussed below:

Facing Increasing Healthcare Expenses

The mounting medical expenses can drain your retirement corpus without proper insurance coverage. It is imperative to have healthcare insurance for senior citizens to avail of the best treatment for medical issues that arise during their golden years.

Critical Illness Cover

The chances of encountering critical illnesses like heart diseases, kidney-related issues, cancer, etc., are higher as you age. Being prepared to manage the treatment costs for these ailments is important. Critical illness insurance provides cover for critical illness in the basic plan or as an add-on feature.

Annual Health Check-up Services

Senior citizens need regular health assessments to maintain good health. The health insurance for senior citizens covers these annual check-up expenses, reducing out-of-pocket expenses.

Peace of Mind

The mounting medical expenses are a cause of concern for retirees without a regular income. A senior citizen health policy covers medical expenses and ensures financial security in medical emergencies. Having a proper health insurance plan can give them peace of mind.

What Does a Health Insurance Plan for Senior Citizens Cover?

Health insurance for senior citizens offers financial security and peace of mind to the elderly. It covers the following expenses associated with a medical emergency:

Hospitalisation Costs

Health coverage for retirees covers hospitalisation expenses that include room rent, doctor’s fees, nursing care and surgery charges, medication, ICU charges, etc. It also covers the cost of orthopaedic implants, artificial limbs, and diagnostic tests required during hospitalisation.

Day Care Treatments

Chemotherapy, dialysis, etc, are daycare treatments that require less than 24 hours of hospitalisation and are covered under medical insurance for senior citizens.

Pre and Post Hospitalisation Expenses

The expenses incurred for diagnostic tests, imaging, etc., to evaluate the medical conditions before hospitalisation and the cost of follow-up treatments after discharge are covered under health insurance plans for senior citizens.

COVID-19 Cover

The best health insurance for senior citizens includes coverage for expenses incurred for COVID-19 treatment giving peace of mind and financial security for the elderly during a critical situation.

Costs for Organ Donation

Organ donation incurs a lot of expenses relating to the donor's medical tests, hospitalisation, surgery, and post-operative care. The health insurance for senior citizens covers these expenses. The facility ensures that the senior citizen can get access to life-saving procedures and undergo the transplant without financial stress.

Ambulance Charges

Ambulance services are required for some medical emergencies to shift the insured to the hospital at the earliest. The senior citizen health insurance plan covers the ambulance charges incurred.

Pre-existing Diseases

The pre-existing health conditions of the insured are also covered in the health insurance for senior citizens. The cover is available after a certain waiting period which varies with the insurer.

AYUSH Treatment Cost

AYUSH i.e., Ayurvedic, Yoga and Naturopathy, Unani, Siddha, and Homeopathy are traditional treatment practices that are recognised and regulated by the government of India. Some medical policies cover the AYUSH treatment cost enabling senior citizens to exercise their preference for conventional treatment methods.

Domiciliary Hospitalisation Cover

Domiciliary hospitalisation cover is provided under insurance plans for senior citizens when the medical condition of the insured does not permit hospitalisation or when beds are not available in hospitals.

What does a health insurance plan for senior citizens not cover?

The following medical expenses are not covered under the health insurance plan for senior citizens.

- Medical expenses incurred for pre-existing diseases.

- Cost of self-inflicted injuries or suicide.

- Treatment expenses involving alcohol or drug abuse.

- Medical conditions detected within 30 days from the date of purchasing the policy.

- Cosmetic surgery expenses.

- The cost of lens/spectacles and dental treatment unless the condition is due to an accident.

- AIDs treatment.

Important Factors When Purchasing Health Insurance for Senior Citizens

Health protection for the seniors is a must, considering the mounting cost of health services in India. To invest in the best health insurance for senior citizens consider the following factors:

Day Care Treatments

Regular insurance policies do not provide coverage for treatments that require less than 24 hours of hospitalisation. With the advancement in technology some of the treatments like chemotherapy, dialysis, radiotherapy, etc., do not require hospitalisation for more than a day. Choose a plan with this facility for extended financial security.

Cashless Hospitals

The insurance companies have a network of hospitals that provide cashless hospitalisation facilities. You should ensure that the network has reputed hospitals close to your location. Explore plans from various insurance companies and choose the plan with network hospitals that are convenient to you.

Effectiveness of Health Insurance Claims

You should consider the ratio of claims settled and the speed of claim settlement while investing in a senior citizen insurance plan. It is recommended to purchase a health insurance plan from an insurer whose claim settlement ratio is high and the turnaround time for claim settlement is comparatively low.

No Claim Bonus

Insurance companies reward the policyholders with a no-claim bonus for each claim-free year. The bonus is generally by way of discounts on renewal premiums or increase in the sum assured. With regular annual check-ups you can take preventive measures to maintain robust health and maintain a clean claim record. Try and minimise your claims to a minimum to reap the rewards of over a period of time.

Free Health Check-up Availability

Regular health check-ups help senior citizens stay updated on their health status. The costs of these diagnostic tests are exorbitant and not everyone can afford the expense involved. Health insurance for senior citizens covers these expenses ensuring that the elderly undergo regular check-ups without disrupting their budget. Ensure to invest in a health insurance plan with comprehensive coverage that includes annual health check-ups.

Co-payment

Some insurance plans have a co-payment clause, where the insurer has to bear a portion of the treatment expenses claimed. It is recommended to go for an insurance plan with a minimum or zero co-payment clause. Policyholders with high co-payments are burdened with unexpected expenses, which defeats the purpose of insurance coverage.

Policy Renewal

An ideal insurance plan should permit policy renewal without an upper age limit. This eliminates the need for investing in new insurance policies as they age. With continuous coverage available through regular policy renewal, senior citizens can have access to healthcare services without financial burden. This provides a peace of mind and also promotes long-term health management and well-being.

Pre-existing Diseases Waiting Period

Most insurance plans for senior citizens cover pre-existing diseases but with a waiting period. Treatments for pre-existing conditions, if not covered by insurance, can drain your savings. Invest in a health insurance plan that has a minimum waiting period for pre-existing diseases.

Documents Required for Senior Citizen Mediclaim Policy Claim

The following documents are required for a MediClaim policy claim to ensure that there is no mismatch in the personal details mentioned in the claim form, medical reports, etc,

Age Proof

Age proof such as a valid Aadhar Card, Driving Licence, Passport, Voter’s ID Card, PAN, or Birth Certificate has to be submitted.

Address Proof

A valid Driving Licence, Aadhar Card, Passport, Voter’s ID Card, or Rental Agreement has to be provided as address proof.

Identity proof

A photo identity proof includes a valid PAN, Passport, Aadhar Card, Driving Licence, or Voter’s ID card.

Claim Settlement Process for Medical Insurance for Senior Citizens

Policyholders must submit a claim for settlement of expenses incurred for either hospitalisation or emergency treatments. They can either opt for cashless hospitalisation at network hospitals or can claim reimbursement of the expenses borne. Follow the process below for easy claim settlement:

Procedure for Getting Reimbursement in Senior Citizen Health Insurance

The steps for reimbursement in senior citizen health insurance are given below:

- If you are hospitalised, notify the insurance company within 24 hours.

- Ensure that all the documents required for claim settlement are collected upon discharge.

- Fill out the claim settlement form and affix your signature.

- Submit the claim settlement form along with the required documents to the TPA or the insurer. The documents include a certificate of admission to the hospital and discharge, pathological reports, doctor’s prescription, and chemist’s bills.

- After reviewing the claim form and the documents submitted for accuracy, the TPA or the insurer settle the claim amount.

Easy Process for Cashless Claims in Senior Citizen Health Insurance

Cashless claims are applicable for treatments at network hospitals. The claim process is given below:

- Get admitted to one of the network hospitals listed in your insurance policy.

- Fill out and submit the pre-authorisation form to the hospital authorities.

- The hospital seeks approval from the TPA or the claims team to initiate cashless hospitalisation of the insured.

- The insurance company settles the bill directly upon discharge from the insured.

Tax Benefits of Health Insurance for Senior Citizens

As per the old tax regime, senior citizens, i.e., individuals who are 60 years and above can avail of certain tax benefits under Section 80D# of the Income Tax Act as mentioned below if they have health insurance. The benefit applies to individual policies as well as plans where the senior citizens are included, for instance, a family floater plan.

Tax Savings on Premium Payments

They can avail of tax benefits under Section 80D# for the premiums paid towards the senior citizen health insurance plan for self and family members, i.e., spouse, dependent children, and parents. There is a cap on the eligible amount depending on the age of the dependent members.

For Seniors Aged 60 and Above

The maximum deduction permitted for senior citizens aged 60 and above is Rs. 50000/-

Extra Tax Deduction for Parents

They can claim an additional Rs. 50000/- for coverage to parents above 60 years of age.

Total Deduction

The total deduction for premiums paid towards health insurance for senior citizens under Section 80D# can go up to Rs. 1.00 lakh if the policyholder and the parents are senior citizens. However, the deduction is permitted subject to the conditions given below:

- The premium should be paid in any other mode other than cash. The deduction is exclusively for health insurance policies.

- The maximum deduction includes the premium paid towards individual policies and family floater plans.

- To avail these benefits the senior citizens should maintain a record of the premiums paid and submit the necessary documents while filing income tax returns.

Why is separate Health Insurance Necessary for Senior Citizens in India?

Regular insurance plans do not accommodate various aspects concerning senior citizens. For comprehensive coverage, separate health insurance is necessary for senior citizens in India. Here are some more reasons that make it compelling to opt for a separate health insurance for senior citizens:

Increasing Healthcare Costs

Accessing appropriate and quality treatment can financially burden senior citizens without a regular income stream. The increasing healthcare costs make it more difficult for them. Healthcare insurance for senior citizens takes care of the hospitalisation and other expenses involved, making timely treatment affordable for them.

Critical Illness Cover

As you age, the likelihood of being diagnosed with serious conditions like renal failure, heart disease, cancer, etc., increases significantly. Senior citizen health insurance plans offer critical illness coverage, providing a lump sum payment for the treatment of the specified conditions.

Annual Health Checkups

To be in the best of health annual checkups are necessary. Most insurance plans enable senior citizens to avail of this facility free of cost. Regular medical screening helps early detection of a medical situation. This enables immediate treatment and reduces the cost involved.

Stress-Free Retirement Living

To pay for expensive medical treatments can be financially stressful when the regular income ceases. With a proper health insurance plan for senior citizens, you can lead a stress-free retirement life as the medical expenses, if any, as the insurer takes care of it.

How Can I Purchase Health Insurance for Senior Citizens?

Health insurance for senior citizens can help you wade through health issues without any financial stress. The insurance company takes care of all the medical expenses. Given below are some pointers to help you purchase the health insurance plan for senior citizens:

Evaluate Your Health Needs

Assess your health needs. Pre-existing illnesses play an important role in the choice of policy so consider it before buying an insurance plan. Insurance companies cover pre-existing medical conditions after a waiting period. Read the terms of the policy carefully and go for the plan that has a minimum waiting period.

Do a Thorough Research

With so many players in the market, you have various plans with extensive coverage. Study and compare the plans available and consider the one with hospitalisation coverage including pre and post-hospitalisation. Plans with coverage for critical illness coverage are a better choice. Comparing premium costs and coverage limits is also important.

Calculate Premium

Age, medical history, and coverage limits are factors that impact the premium. Calculate and compare the premiums of the plans that you have chosen. The premium increases with age so you should go for a plan with a premium that remains affordable in the long run.

Check Network Hospitals

Some insurance plans offer cashless treatment in specific hospitals mentioned in the policy terms. Look for a plan that has network hospitals closer to your location. This makes cashless hospitalisation possible and simplifies the claim process.

Compare the Waiting Period

Health insurance plans for senior citizens provide coverage for existing illnesses but with a waiting period. Compare the waiting period clause of different insurance policies and settle for the one with a minimum waiting period.

Fill Out The Application Form

Decide on the insurance plan to purchase and fill out the relevant application form. If you find it difficult to fill the form, you can take assistance of the insurer or seek any clarifications required.

Medical Check-Up

The premium assigned depends on your existing health condition. Some plans may require you to undergo a medical check-up to evaluate your health status.

Check the Policy Document

Read the terms and conditions of the policy document. Check for the coverage limit and exclusions before making the payment. If you have any doubt you can seek clarifications from the insurance company.

Make the Payment

After carefully studying the policy document, make the payment. Continue to make the premiums regularly to keep your policy active.

Submit Claims Promptly

Whenever you are hospitalised or undergo emergency treatment, notify the insurance company and submit the claims promptly. File the claim as per the guidelines mentioned in the policy document.

Maintain Proper Records

Keep a record of the expenses and the communication with the insurance company. This will come in handy during the claim process.

Common Misconceptions about Health Insurance for Senior Citizens in India

Here are some of the common misconceptions about health insurance for senior citizens in India:

Health Insurance for Senior Citizens is Expensive

The premiums for health insurance increase with age. But there are several insurance plans specially designed for senior citizens and they can choose a plan that is affordable and suits their budget. The Pradhan Mantri Vaya Vandana Yojana (PMVVY) introduced by the government, offers health insurance for senior citizens at affordable premiums.

Senior Citizens cannot get Insurance Cover

This is not true. Several health insurance plans designed for the specific health needs of senior citizens are available. They provide comprehensive coverage for a range of medical expenses.

Insurance Coverage is Limited for Senior Citizens

Insurance for older adults provides cover for various treatment expenses, including in-patient hospitalisation expenses, pre and post-hospitalisation expenses, and ambulance charges. Understand the coverage limit before investing in a policy.

Senior Citizen Insurance Plans do not Cover Existing Illnesses

Most of the senior citizen health insurance policies cover existing medical conditions but with a waiting period that varies with the insurer. Read the policy terms for clarification regarding this feature and go for a plan that has a minimum waiting period.

Complex claim process

The claim process is not as complicated as it appears to be. With the assistance of the insurer, you can easily fill out the claim form. Proper documentation makes the process seamless. The cashless hospitalisation facility further simplifies the claim process for senior citizens.

Latest Update on Senior Citizen Health Insurance Premium by IRDAI

As per the IRDAI circular dated 30th January 2025, the insurance companies cannot increase the premiums towards senior citizen health insurance plans beyond 10% in a financial year without approval. If they intend to escalate the premium beyond 10% or terminate a senior citizen health insurance plan, they can do so only with the approval of IRDAI.

This update was a step taken owing to the complaints received by senior citizens regarding the steep hike in health insurance premiums year on year. Some of the insurance companies had enhanced the premiums by almost 100% making it difficult for senior citizens to avail of comprehensive health coverage.

Summary

Meeting the rising medical costs can be daunting for senior citizens without a regular income stream. Investing in health insurance for senior citizens enables access to modern treatment methods and helps protect long-term savings typically set aside through options like the Senior Citizen Saving Scheme, which is often meant for predictable post-retirement needs. The senior citizen insurance plans provide extensive treatment expenses including in-patient hospitalisation, pre and post-hospitalisation and ambulance charges. With the facility of lifetime renewability, senior citizens can lead their retired lives peacefully without worrying about the medical emergencies that may arise.

FAQs on Health Insurance For Senior Citizens

Q. What is the best health insurance for seniors?

The best health insurance for seniors is the one that provides comprehensive coverage, including a range of medical expenses such as hospitalisation expenses, pre and post-hospitalisation expenses, ambulance charges, and preventive health check-ups.

Q. What is the cheapest health insurance for a 60-year-old?

Various health insurance plans are available for senior citizens. You can compare the premiums and buy the one with a premium that suits your budget.

Q. How do you choose health insurance for senior parents?

Compare the coverage for pre-existing conditions, premiums, cashless facilities, coverage limit, renewability, claim process and other benefits like domiciliary care before purchasing health insurance for senior parents.

Q. What is the maximum age for senior citizen health insurance?

Most insurance plans for senior citizens provide lifetime renewable facilities. So, there is no upper limit for senior citizens' health insurance.

Q. Are critical illnesses covered under health plans for senior citizens?

Yes. Critical illness covers life-threatening conditions like renal failure, heart disease, cancer, etc., that require expensive treatment and is covered under health plans for senior citizens.

Q. Is there any government scheme for senior citizens?

Yes. The Union Cabinet 2024 announced a special health insurance for senior citizens in India, i.e., Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (ABPMJAY). Under the scheme, senior citizens 70 years and above are given coverage up to Rs. 5.00 lakhs in a financial year, irrespective of their economic status.

Q. What is the age limit for senior citizens for ladies?

The age at which females are considered senior citizens in India is 60 years and above.

Need Help to Buy a Right Plan?

Our expert will assist you in buying a right plan for you online.

Reach us between 8:30 AM - 10 PM IST.

For existing policy related assistance, click here.

A certified expert of HDFC Life will help you.

99.68% Claim Settlement Ratio

For FY 2024-2025

~5 Cr. Number Of Lives Insured

For FY 2024-2025

Disclaimer: By submitting your contact details, you agree to HDFC Life's Privacy Policy and authorize ...Read More

99.68% Claim Settlement Ratio

For FY 2024-2025

~5 Cr. Number Of Lives Insured

For FY 2024-2025

Here's all you should know about Health Insurance.

We help you to make informed insurance decisions for a lifetime.

HDFC Life

Reviewed by Life Insurance Experts

HDFC LIFE IS A TRUSTED LIFE INSURANCE PARTNER

We at HDFC Life are committed to offer innovative products and services that enable individuals live a ‘Life of Pride’. For over two decades we have been providing life insurance plans - protection, pension, savings, investment, annuity and health.

Popular Searches

- term insurance

- Health Insurance Plans

- What is Health Insurance

- Benefits of Health Plans

- BMI Calculator

- Human Life Value Calculator

- HDFC Life Cardiac Care

- Savings Plans

- ULIP Plans

- Group Insurance Plans

- Child Insurance Plans

- Pension Calculator

- ULIP for Health Benefits

- Compound Interest Calculator

- Easy Health Plan

- How to Choose Best Child Insurance Plan

- Fixed Maturity Plan

- ULIP Vs SIP

- Financial Planning for your 50s

- Zero Cost Term Insurance

- critical illness insurance

- Whole Life Insurance

- types of term insurance

- Benefits of Life Insurance

- Endowment Policy

- child savings plan

- life insurance

- life insurance policy

- Health Insurance of smokers

- Health Insurance of Self employed

- Types of health insurance

- Health Insurance for Women

1. Annual Premium amount ₹ 1869 for Male aged 35 years, Base Benefit, 10 years term, Regular Pay option, Sum Assured=10 lakhs, excluding Taxes & levies as applicable.

# Tax benefits are subject to conditions under Section 80D and other provisions of the Income Tax Act, 1961. Tax Laws are subject to change from time to time.

This material has been prepared for information purposes only, should not be relied on for financial advice. You should consult your own financial consultant for any financial matters.

ARN - MC/02/25/21190