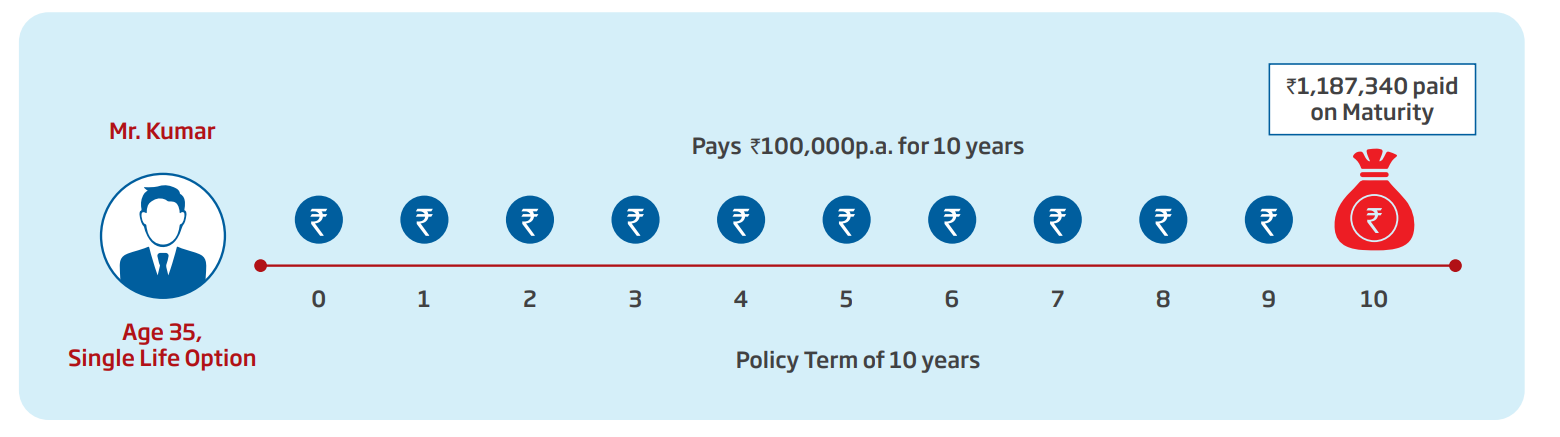

How does HDFC Life Sanchay Plus work?

HDFC Life Sanchay Plus is a traditional endowment plan that is designed to cater to your wholesome financial needs. On one hand, it pays a lumpsum amount if the policyholder dies an untimely death. While on the other, it also acts as a good investment plan, that provides a lumpsum maturity benefit or life-long regular pay-outs in case the policyholder survives the policy term. The policy term options range between 15-25 years while the premium paying term can be 5, 8 or 10 years.

Sample Illustration:

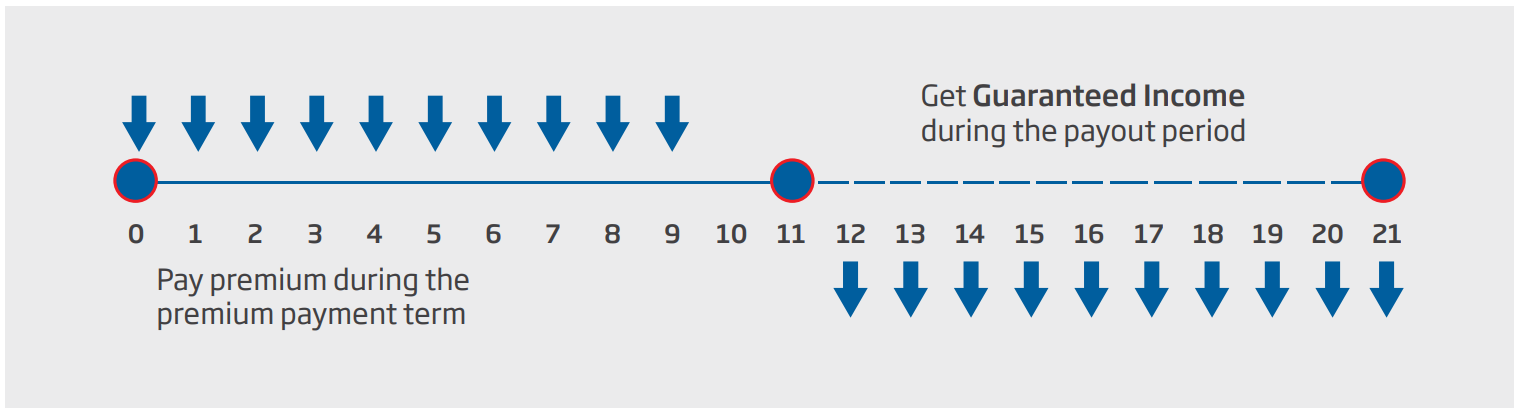

How does HDFC Life Sanchay Fixed Maturity Plan work?

This insurance plan is structured to cater to the financial needs of single or multiple persons and provide them with guaranteed1 incomes, devoid of any market risk element. The policy thus offers single or joint life coverage, flexible premium payment and larger maturity benefit for higher premiums. Hence, the policy can be a wise bet if you are looking to secure the lives of your loved ones. The applicant can choose the policy term based on their convenience from the range of up to 40 years.

Sample Illustration:

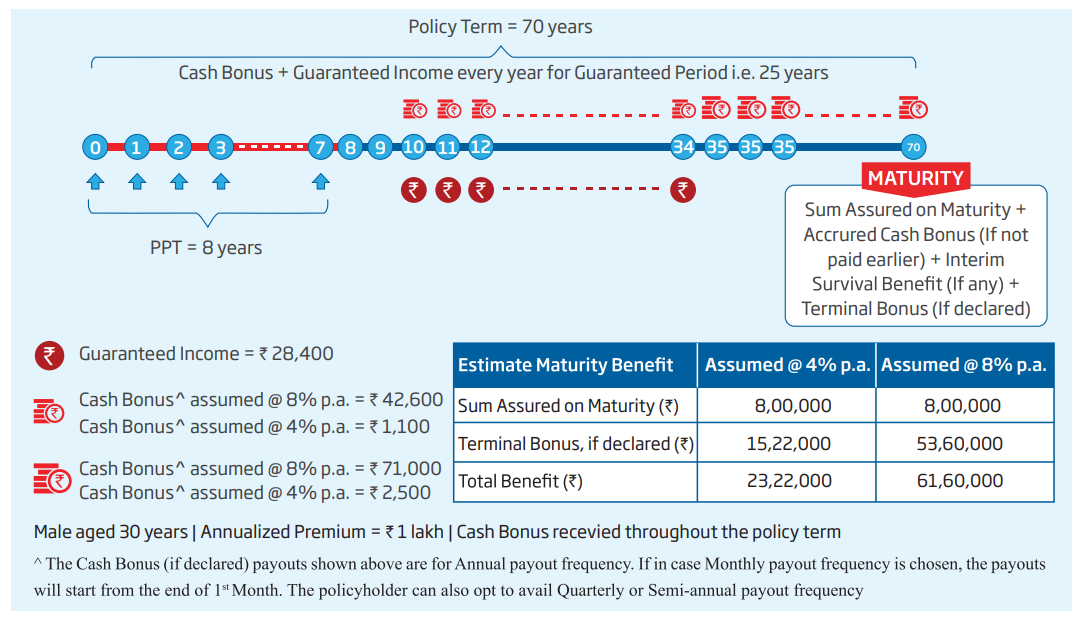

How does HDFC Life Sanchay Par Advantage work?

If you are looking out for an insurance policy that would act as a savings plan to manage your expenses and financial needs, HDFC Life Sanchay Par Advantage can be your pick. A cumulative benefit of whole life cover + lifelong income, guaranteed deferred income, tax exemptions and additional riders is sure to make the policyholder’s life easy and hassle-free. Based on the chosen plan option, the policyholder or his/her family can get the sum assured in an immediate income or deferred income format.

In addition, the policyholder receives a cash bonus amount for surviving through each year of the policy term. You can avail of this annually from the end of the 1st policy year until the end of the policy term. In case of death of the policyholder during the policy term, the nominee gets the pre-defined sum assured along with the accrued bonus (if not paid earlier), interim survival bonus (if any) and Terminal Bonus (if declared).

For perspective, HDFC Life declared its highest ever bonus of Rs 3,660 cr. on participating plans for 2022-23, benefitting a total of 23.14 lakh policyholders who were eligible for this bonus.

Sample Illustration: